Top 11 Compound Interest Investments

Warren Buffett attributes the bulk of his $150+ billion net worth to “a combination of living in America, some lucky genes, and compound interest.”

That last one — compound interest — is a relatively simple concept, but it has staggering effects.

In short, compound interest is what happens when your earnings generate their own earnings. It's interest on interest, and over time, it can turn small sums into serious wealth.

Say you invest $100 at a 5% annual return. After one year, you have $105. In year two, you earn 5% on the full $105 — bringing your total to $110.25. That extra $0.25 is compound interest — the interest earned on your previous interest.

It's a modest difference at first. But as the years go on, the compounding effect accelerates — and the gap between saving and compounding gets wider and wider.

The power of compound interest

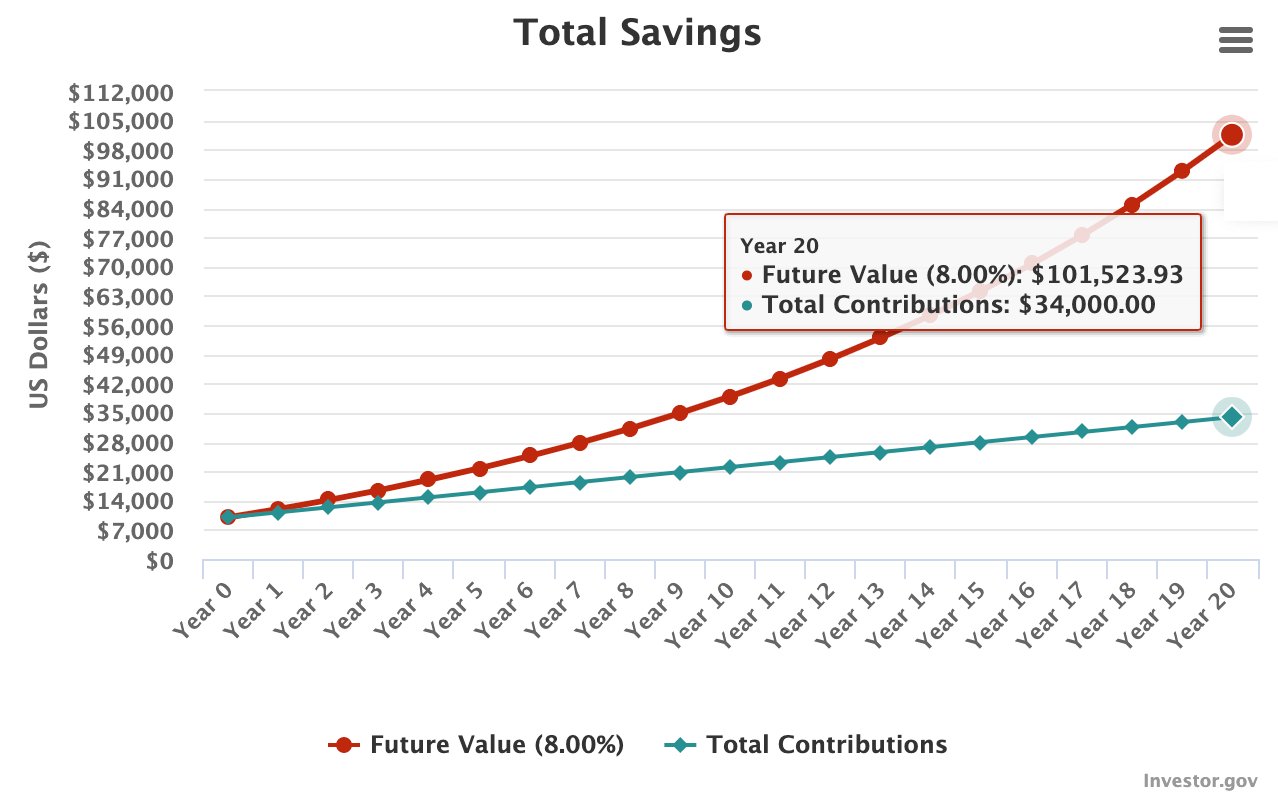

For instance, imagine you start with an initial investment of $10,000, contribute $100 per month, and earn an 8% return. After 20 years, you will have over $101,500:

Source: Investor.gov

The best part? Only $34,000 of that $101,523 was contributed. The rest — nearly $67,500 — came from growth, mostly from compound interest.

As you can see, compound interest can turn meager investments into serious wealth. But it only works if you get three things right.

How to make compound interest work for you

To harness the power of compound interest, you need three things:

- An initial investment and/or regular contributions (the more the better)

- Positive returns (the higher the better)

- Time (the longer the better)

The more you invest, the higher your returns, and the longer you stay invested, the more compounding works in your favor.

With that in mind, here are 11 of the best compound interest investments available today.

Some are lower-risk and predictable — like Treasuries, HYSAs, and CDs. Others carry more risk but offer higher potential returns — such as stocks, real estate, and alternatives.

Generally, the higher the risk, the greater the potential return. For example, stocks are more volatile than bonds but have historically generated higher long-term returns.

Most investors balance risk and reward by owning a mix of assets (say 70% stocks, 20% bonds, and 10% cash). This is known as diversification.

When building your investment portfolio, be sure to choose a combination of investments that meet your risk tolerance and long-term goals.

The 11 best compound interest investments

Disclaimer: I've given each investment below an overall rating, as well as a return and risk score out of 5. These are personal opinions. Actual results may vary. Be sure to conduct your own due diligence.

1. Treasury bills

- Overall rating:

- Potential returns: 2/5

- Risk level: 0/5

- Best for: Everyone

Treasury bills (also called Treasuries or TBills) are short-term debt issued and backed by the U.S. government.

Treasuries are widely considered one of the safest investments in the world. The 2-year Treasury is even known as the “risk-free rate.”

That's because the U.S. government is the most creditworthy borrower on earth — it brings in trillions in tax revenue (the most reliable income stream there is), and, if needed, it can print money to cover its debts.

Personally, I keep my emergency fund — plus most of my idle cash — in Treasuries. (Keep reading to see what I do with the rest of my cash.)

You can buy individual Treasury bills directly in your brokerage account (Fidelity, Schwab, TD Ameritrade, Public, etc.), or take a more hands-off approach with a short-term Treasury ETF like SGOV, which is what I use.

If you need a brokerage, we recommend Public, which makes it easy to invest in stocks, ETFs, Treasuries, crypto, and more — all in one account.

Why I'd choose it: Everyone should have an emergency fund with at least 6 months' worth of living expenses saved. Instead of letting this money sit in a bank account, you can earn higher interest with less risk by investing in Treasury bills.

2. Stocks & ETFs

- Overall rating:

- Potential returns: 3–4 out of 5

- Risk level: 3/5

- Best for: Everyone

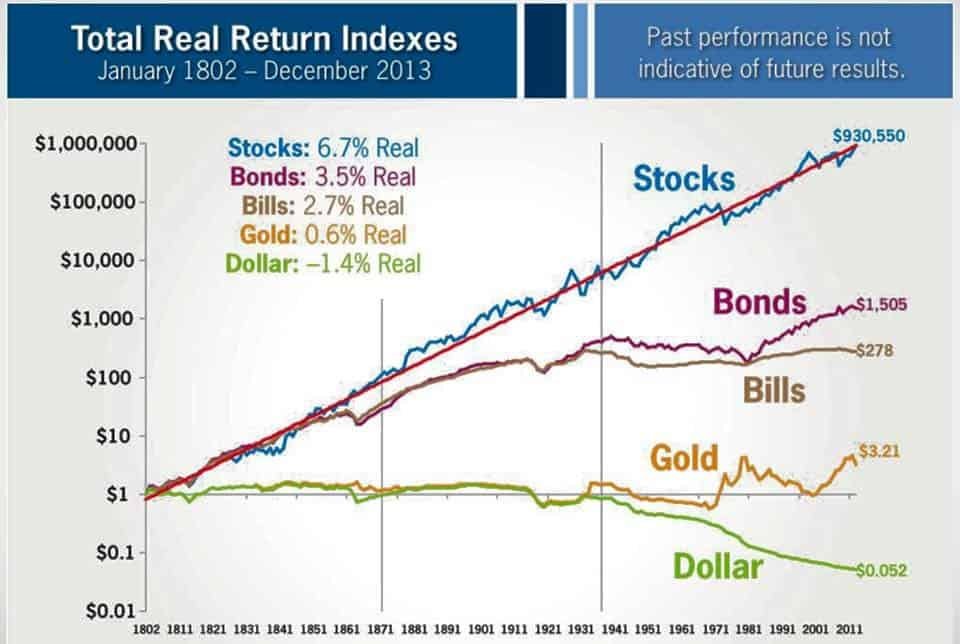

Historically, stocks have outperformed nearly every other asset class — including bonds, Treasuries, gold, and cash.

From 1802 to 2013, stocks delivered an annual average return of 6.7% (net of inflation), almost double the return of bonds (3.5%) and more than double the return of Treasury bills (2.7%):

Source: Wealth Capitalist

While a 3.2% difference may not seem like much, the actual effects can be quite large over a long enough time horizon. For example, $100,000 invested for 20 years at those rates would grow to:

- Stocks (6.7%): $365,838

- Bonds (3.5%): $198,979

That 3.2% per year turned into a difference of nearly $167,000.

If you want your money to compound at the highest possible rate, allocating some of your portfolio to stocks is probably a good idea.

For most people — especially beginners — ETFs (exchange-traded funds) are the easiest way to invest in stocks. They provide instant diversification by holding dozens (or hundreds) of companies in a single fund.

A few of my favorite ETFs are:

- Vanguard S&P 500 (VOO): Holds the 500 most valuable publicly traded companies in the United States.

- Vanguard Total World Stock Index Fund (VT): Holds every publicly traded company in the world.

- Invesco QQQ (QQQ): Holds the stocks that make up the tech-heavy Nasdaq-100 index.

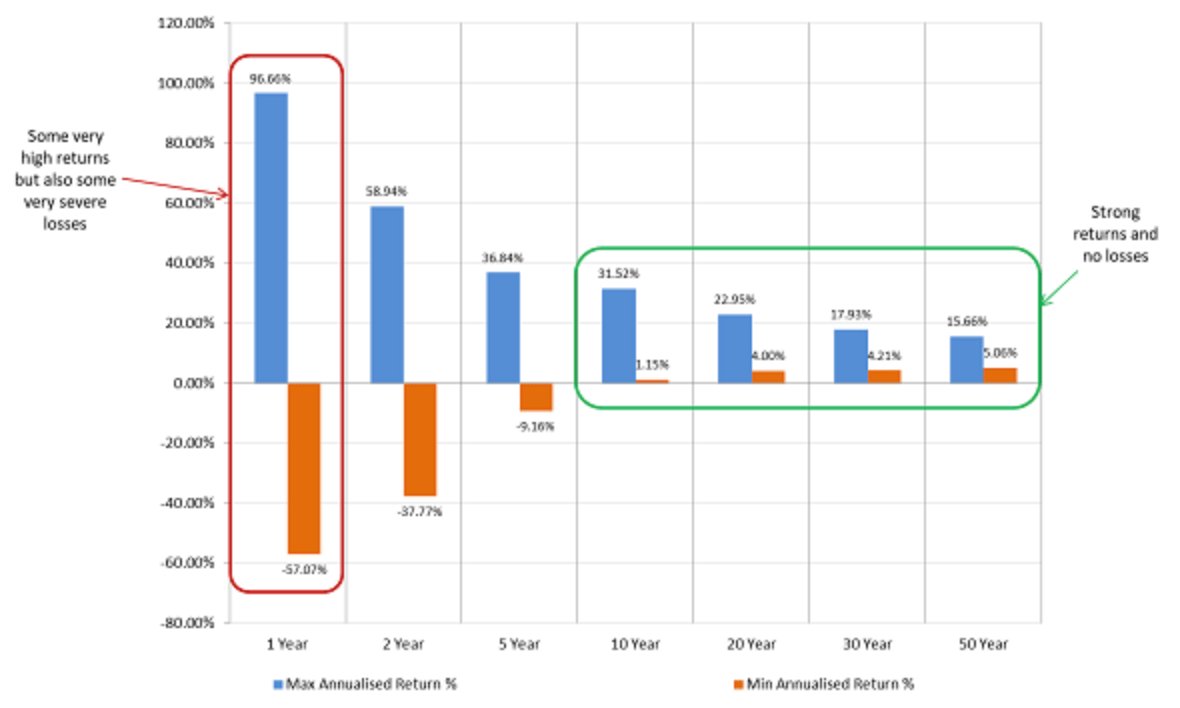

While stocks can be volatile in the short term, the longer your holding period, the more predictable the returns.

For example, between 1900 and 2017, 1-year U.K. stock returns ranged from +96.66% to -57.07%, but 10-year returns narrowed to a range of +31.52% to +1.15%:

Source: AJ Bell

If you have a long time horizon, investing in stocks is one of the best ways to put the power of compound interest on your side.

You can buy stocks and ETFs in your brokerage account. If you need a brokerage account, our #1 recommendation is Public.

Why I'd choose it: Because of their long-term outperformance, stocks are one of the most popular and effective means for building wealth via compound interest.

They can be volatile, especially in the short term, but you can significantly reduce the risk of investing in stocks by having a holding period of 10+ years.

3. Corporate bonds & bond ETFs

- Overall rating:

- Potential returns: 2/5

- Risk level: 2/5

- Best for: Income-seeking investors (primarily those who are in or near retirement age)

Corporate bonds are debt instruments issued by publicly traded companies to finance operations, growth, R&D, acquisitions, and more.

In return for lending money to the company issuing the bond, investors receive regular interest payments throughout the duration of the loan plus the original principal once the bond matures.

Unlike an equity investment, companies are legally obligated to pay back their debt regardless of how the business is performing. Because of this, corporate bonds are generally less risky (and tend to have lower returns) than stocks.

However, since companies are more likely to default than the U.S. government, corporate bonds typically pay higher interest rates than Treasuries.

Right now, for example, the 10-year Treasury is yielding around 4.09%, while the highest-quality 10-year corporate bonds are yielding about 5.18%.

Instead of buying individual bonds, you can invest in bond ETFs, which hold baskets of bonds from a variety of issuers, with different maturity dates and interest rates.

Unlike most individual bonds — which pay interest twice a year — bond ETFs typically make monthly income distributions, providing more consistent cash flow.

You can use our ETF screener to search for the perfect bond ETF for your portfolio.

Why I'd choose it: Corporate bonds and bond ETFs are great for income-seeking investors and those looking for stability in their portfolios.

Most legacy brokerages (Fidelity, Vanguard, Schwab) offer corporate bonds, and almost every broker will offer bond ETFs. If you still need a broker, you can buy both individual bonds and bond ETFs on Public.

4. Private credit

- Overall rating:

- Potential returns: 3–4 out of 5

- Risk level: 3/5

- Best for: Accredited investors who want short-term income and diversification outside of public markets

Mid-sized private companies, which don't have access to the public markets and are too big to get loans from traditional banks, must turn to private markets for financing.

This part of the market is known as private credit.

Because capital is less readily available, private credit borrowers must offer favorable terms to attract investors. Most private credit deals entail:

- Short-term durations: Most deals have a maturity period of ~16 months.

- Double-digit yields: Because capital is less readily available, private credit borrowers must offer higher interest rates to attract investors (deals on Percent have generated a 14.47% historical-weighted average APY).

- Diversification: Private credit offers unique diversification outside of public equity and debt markets.

Historically, private credit has only been available to institutional investors. Firms like Blackstone, Goldman Sachs, and KKR have been committing hundreds of billions to private credit.

And now, accredited investors can participate in similar deals on Percent.

Why I'd choose it: Short-duration income and diversification outside of public markets.

If you're an income-seeking, accredited investor, you should try Percent. You can also get a welcome bonus of up to $500 through our links.

To learn more about the platform, read my full Percent Review.

5. High-yield savings account

- Overall rating:

- Potential returns: 1–2 out of 5

- Risk level: 1/5

- Best for: Everyone

To complement my Treasuries account (which holds the bulk of my cash), all of my bills and credit cards are paid off with the cash I keep in a high-yield savings account. I usually keep enough cash to cover about 2 months' worth of bills in this account.

Most high-yield savings accounts are offered by online banks, which don't have the costs associated with operating physical banks. These savings are then passed on to customers through higher yields.

Other than paying higher rates, these savings accounts operate the same way as traditional savings accounts, making them a much better option for anyone who doesn't need the services of a physical bank.

I keep cash in a high-yield savings account for convenience. While the returns are slightly lower (and the risk is marginally higher) than buying Treasuries, it's much simpler to pay bills from a savings account.

If you decide to open a high-yield savings account, be sure the rate isn't a teaser rate and make sure there are no monthly fees or account minimums.

You can get a high-yield savings account (paying 3.50%) for free on Chime by opening a checking account and making a direct deposit of $200 or more in the first 34 days.

You can also use Raisin to compare a number of HYSA options at once. Plus, with Raisin, you can fund and manage savings products at multiple banks from a single login.

Why I'd choose it: Everyone should have a checking/savings account to pay bills with, and a high-yield savings account offers rates much higher than traditional banks — when I switched banks, my new rate was 55x higher.

6. Real estate

- Overall rating:

- Potential returns: 3/5

- Risk level: 2–3 out of 5

- Best for: Long-term investors who want to diversify their portfolios outside of public markets

Real estate has long been one of the most popular paths for building wealth.

Real estate investors benefit from price appreciation, rental income, and tax breaks. It's also less volatile than the stock market and has historically been a good hedge against inflation.

However, large capital requirements have prevented the vast majority of investors from purchasing real estate.

But this is no longer an issue.

Today, crowdfunding real estate platforms allow you to start buying properties with much smaller sums. These platforms handle the due diligence, paperwork, management, and maintenance of every deal.

For retail investors, the best platform for real estate investing is Arrived. You can get started in minutes with just $100.

Accredited investors can access more sophisticated deals on EquityMultiple. On EquityMultiple, you can invest in commercial real estate via equity offerings, senior debt positions, and short-term notes.

Why I'd choose it: Real estate has long been one of the most conventional ways to create wealth. It provides investors with a consistent income stream and the potential for price appreciation.

And, because of crowdfunding platforms like Arrived and EquityMultiple, it's never been easier to get started in real estate (which is also one of the best ways to invest $1 million).

7. Certificates of deposit (CDs)

- Overall rating:

- Potential returns: 1–2 out of 5

- Risk level: 1/5

- Best for: Short-term savings

Certificates of deposit (CDs) are a type of savings product offered by banks that offer fixed interest rates in return for locking your money up for a set period of time.

Unlike a traditional savings account, which allows you to access your money whenever you want, investing in a CD tells your bank that you won't touch that money for the duration of the CD (typically 3, 6, 12, or 18 months).

This gives the bank more flexibility in how it will lend the funds, and, in return, the bank will offer a higher interest rate than it would on a regular savings account.

Why I'd choose it: If you know you won't need some cash for a certain period but don't want to move it out of your bank and into your brokerage to buy a Treasury, investing in a CD is a good middle ground.

You can compare CD products and invest across multiple banks at once on Raisin.

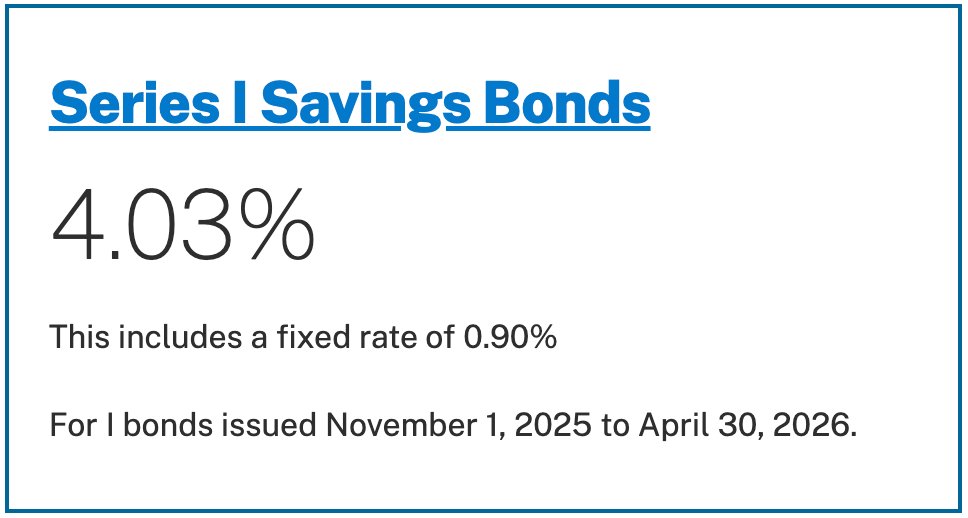

8. Series I bonds

- Overall rating:

- Potential returns: 1–2 out of 5

- Risk level: 1/5

- Best for: Income-seeking investors who want to combat inflation

Series I bonds are issued by the U.S. government and have a fixed interest rate and a fluctuating interest rate that is tied to inflation.

After issuance, the fluctuating portion of the interest rate is adjusted every 6 months based on the current inflation rate.

Source: TreasuryDirect

I bonds have a minimum holding period of 5 years. They can be sold after 12 months, but if you sell them prior to the 5-year mark, you will forfeit the previous 3 months' worth of interest as a penalty.

You can buy I bonds directly from the U.S. government via the TreasuryDirect website. You can purchase up to $10,000 in I bonds each year.

Why I'd choose it: I bonds are good for medium- to long-term savings and a good hedge against inflation.

9. Health savings account (HSA)

- Overall rating:

- Potential returns: 2–3 out of 5

- Risk level: 2–3 out of 5

- Best for: Anyone with a high-deductible medical plan

An HSA is a savings account where you can set aside pre-tax money to use for medical expenses.

After setting it aside, you can invest your HSA money in ETFs, mutual funds, or other investment products that your provider offers. Like a standard retirement account, this money grows tax-free.

However, unlike a retirement account, the money is not taxed if you make a withdrawal to pay for a qualifying medical expense.

This makes HSAs the only account type that offers a “triple tax advantage" — 1) money is contributed pre-tax, 2) it grows tax-free, and 3) it is not taxed upon withdrawal (when used for medical expenses).

Once you turn 65, you can start using your HSA for non-medical expenses, though you'll have to pay income tax on the distribution (just like a traditional IRA or 401(k) account).

HSAs are only available to individuals with qualifying, high-deductible medical plans. You can open an HSA at certain banks, credit unions, and other financial institutions (I use Health Equity).

Why I'd choose it: If you are on a high-deductible medical plan and qualify for an HSA account, you should consider contributing the max limit each year to take advantage of the triple tax benefits.

10. Alternatives (cryptocurrency, art, collectibles, etc.)

- Overall rating:

- Potential returns: 3–4 out of 5

- Risk level: 4–5 out of 5

- Best for: Investors looking for extra diversification who aren't afraid of the speculative nature of alternatives

Alternatives are a general asset class that I'm using to refer to anything outside of traditional investments like stocks, bonds, and cash. Investment options include cryptocurrencies, art, collectibles, commodities, private equity, hedge funds, and more.

Many investors incorrectly assume that all alternatives are riskier than traditional investments, but that's not necessarily the case.

According to research by BlackRock, certain alternatives (like private credit and real estate) can “lower volatility, enhance returns, and broaden diversification of a portfolio.”

If you're looking for platforms to invest in alternative assets, check out:

- Willow Wealth: Willow Wealth is the biggest alternative asset platform and offers 10 alternative asset classes, though it's primarily made for accredited investors.

- Percent: Percent has the best selection of private credit investments, one of the most popular alternative assets — though it's only available to accredited investors.

- Masterworks: Masterworks is the best platform for investing in fine art.

- Public: With Public, you can invest in cryptocurrencies alongside your stock and ETF portfolio.

Why I'd choose it: If you're interested in and willing to do the necessary research, investing in alternatives is an increasingly popular way to add diversification and the potential for higher returns to your portfolio.

11. Money market account

- Overall rating:

- Potential returns: 1–2 out of 5

- Risk level: 1/5

- Best for: Someone who wants to combine their physical bank's checking and savings accounts

Money market accounts are another way for you to earn compound interest from your bank, and function like a combination of savings and checking accounts.

Like a savings account, you earn interest on your balance, but you may be limited to the number of withdrawals you can make. Like a checking account, your account may come with paper checks and a debit card.

These accounts are convenient and flexible solutions, but I wouldn't recommend them to most people. Most people would be better off with dedicated accounts for checking, savings, and investing as opposed to a watered-down combination of the three.

That said, I know people who prefer to have just one account, rarely make transactions, and prefer their bank's money market account over online, high-yield savings accounts.

Why I'd choose it: If you want access to a physical bank, rarely make transactions, and want to have only one account, check out your bank's money market account offerings.

You can compare money market accounts (and fund multiple accounts at different banks at once) on Raisin.

How we chose the best compound interest investments

When evaluating investments, we consider the following:

- Returns: How has the investment performed historically? How is it expected to perform in the future? How stable/reliable are those returns expected to be?

- Risk: How much volatility should be expected? How much confidence can we place in the expected returns? How much downside is possible? How stable is the investment?

- Duration: How long should the investment timeline be? Should the investment be held for weeks, months, or years?

- Popularity: How popular is the asset among investors? Has the asset class been around for a long time, or is it relatively new?

- Accessibility: How easy is the investment to buy and sell? How simple is it to create an account and start investing? Are the recommended platforms easy to navigate?

More on compound interest

What is compound interest?

Compound interest is the “interest on interest” — it's the interest you earn on your interest from the previous period.

For example, a $1,000 investment that earns 10% interest will be worth $1,100 after the first year, with $100 coming from interest. In year two, the investment will grow from $1,100 to $1,210, or $110 in interest.

The additional $10 you earned in interest in year two is compound interest — it's the interest you earned from the $100 of interest you earned in year one.

This can add up quickly. Assuming your $1,000 investment continues earning 10% per year, your resulting balance would be:

- $1,100 after 1 year

- $1,210 after 2 years

- $1,610 after 5 years

- $2,594 after 10 years

- $6,728 after 20 years

The lesson: Invest early and give your money plenty of time to compound.

How to earn compound interest

Anytime you invest, you're giving your money a chance to compound. You can earn compound interest by investing in stocks, Treasuries, private credit, real estate, CDs, and more.

There are 3 key ingredients to earning compound interest:

- An initial investment (and/or regular contributions)

- Generate positive returns

- Time

The most important of these three is time. The longer your investment has to grow, the bigger it will become.

How to open a compound interest account

Here are the steps you need to take to open a compound interest account:

- Decide what you want to invest in (stocks, bonds, HYSA, etc.)

- Choose what type of investment account you need

- Compare options (costs, fees, welcome bonuses)

- Sign up for an account

- Fund your account

- Invest

Be sure to do your due diligence on the account you open and the investment(s) you make, but don't wait too long to start — remember, time is your friend.

Final verdict

That's my list of the best compound interest investments in 2025.

You can use this guide as a starting point, but be sure to do your own research before committing to any specific account or investment. What works best for you will depend on your goals, timeline, and risk tolerance.

While the effects of compound interest might seem small initially, even small contributions can add up to significant growth given enough time.

No matter what you choose, the most important step is getting started — the sooner you invest, the sooner compound interest can start working in your favor.

.png)

.png)