5 Ways to Invest in Pre-IPO Stocks

Investors are drawn to pre-IPO stocks for one reason: an early investment in the right company can lead to massive returns.

It's not uncommon for a private equity investment to 10x, 20x, or even 100x before a company's public offering. For instance, Blackbird VC's first $3 million investment in Canva is now worth over $1.3 billion, a return of 441x.

Of course, most deals don't end like that. Many lose money. But in venture investing, a single big winner can more than offset an otherwise mediocre portfolio.

Historically, getting access to pre-IPO stocks required knowing the right people and having millions in the bank. While those things still help, they're no longer prerequisites. In 2025, it's easier than ever to get exposure to pre-IPO companies — even as a solo investor.

This guide breaks down how pre-IPO investing works, what to watch out for, and five ways you can start investing in private companies before they go public.

What are pre-IPO stocks?

Pre-IPO stocks are private companies that haven't yet gone public via an IPO (initial public offering) or SPAC, but plan to in the future.*

*Since venture capital firms invest with the goal of a large exit, going public is usually the final step in the growth cycle.

Until then, their shares are owned privately by founders, employees, and outside investors — like venture capitalists, private equity firms, and other private investors.

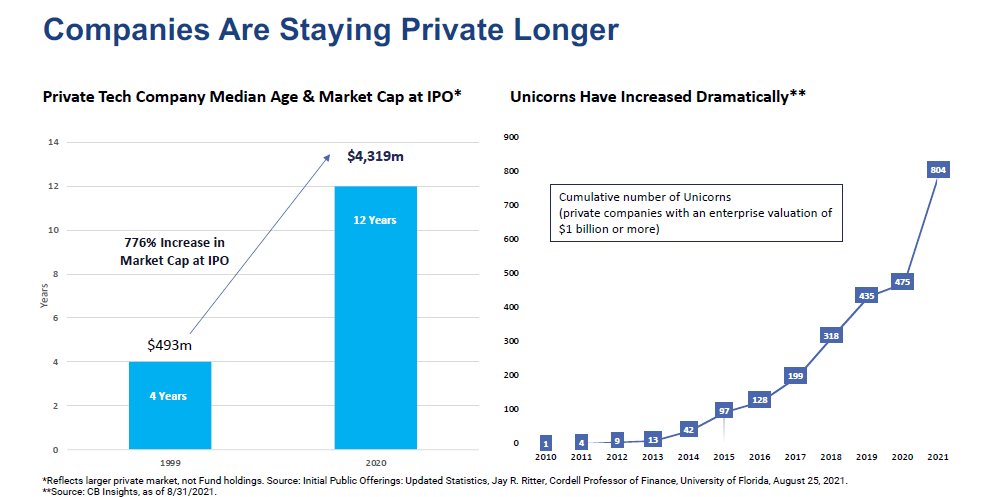

Over the past two decades, the pre-IPO landscape has changed dramatically.

Venture capital firms are now investing at earlier stages and with more capital than ever before. That influx of funding means startups can stay private much longer — and grow much larger — before hitting the public markets.

Source: ETF Trends

In the early days of companies like Microsoft, Apple, Amazon, and Google, going public was a critical milestone — it was the primary way companies raised money to fuel growth.

That's no longer the case. For many of today's top startups, an IPO isn't about raising money — it's a liquidity event. It's when founders, early employees, and private investors get to sell their shares and reap huge gains.

It's only at this point, after a substantial portion of the returns have been captured, that retail investors can invest.

Fortunately, there are now ways for individual investors to participate alongside private equity and venture capital firms and invest in companies before they go public.

The 5 best ways to invest in pre-IPO shares

1. Buy shares on a pre-IPO marketplace

Thanks to regulatory changes, accredited investors can now buy shares of pre-IPO companies.

But who are the sellers?

In most cases, they're employees. As equity compensation has become the norm in startup culture, employees are frequently given stock options instead of higher salaries.*

*By giving away equity instead of cash, companies can significantly reduce their cash expenses. Stock options also help retain employees.

But these shares are illiquid. Employees might hold millions in paper value, yet be unable to touch it.

That's where pre-IPO marketplaces come in. These platforms connect investors who want access to private companies with employees (or other shareholders) looking to sell their stock.

It's a win-win: employees get cash for their shares, and investors get equity in private startups they otherwise wouldn't have access to.

Some of the most popular platforms in this space include:

| Hiive | Linqto | Forge | EquityZen | |

| Best for | Best overall | Fastest transactions | Liquidity | Fund offerings |

| Pros | Transparency, liquidity, & low fees | Speed & a low investment minimum | High trading volume | Several multi-company fund offerings |

| Cons | Mid-range investment minimum | Highest costs | Buyer fees & a high minimum | Few offerings & low liquidity |

| Companies available | 3,000+ | ~85 | 5,100+ | 450+ |

| Investment min. | $25,000 | $1,000 | $100,000 | $10,000 |

| Learn more | Learn more | Learn more | Learn more |

Note: I've ranked these in order of our recommendations from left to right.

Each platform works a bit differently. For instance, Hiive operates much like a traditional marketplace — sellers list their shares and asking prices, buyers place bids on those shares, and transactions are brokered once there's a match.

Because of its marketplace model, Hiive tends to have the most accurate and up-to-date prices. Even if you end up buying on another platform, it's worth having an account on Hiive to make sure you're getting the best price.

Hiive also has one of the largest selections of private companies, low investment minimums, and solid liquidity. That's why we've rated it best overall.

That said, company availability and pricing can vary across platforms. Many investors sign up for multiple marketplaces and evaluate deals on a case-by-case basis — choosing whichever platform offers the best terms for a specific company.

Be sure to do your due diligence and familiarize yourself with each platform's fees and terms before investing.

Keep in mind: these platforms are for accredited investors only, and some are also restricted to U.S. investors.

2. Become an angel investor

Another way to invest in pre-IPO companies is by becoming an angel investor.

Angel investors are typically former entrepreneurs or executives who have money, connections, and expertise, and are willing to take on the risk of investing in early-stage private companies.

Most angel checks range from $200,000 to $400,000, though the exact figures can vary significantly. Some deals are smaller, closer to $25K–$50K, while others run into the millions.

But money alone isn't enough. Angel investors also need connections.

In most cases, angel investors get in through relationships — they know somebody at the company, have a mutual connection with the founder, or are known as an industry expert. Founders often seek investors who've built successful businesses in the same space and can offer guidance, not just capital.

Having expertise in the industry doesn't just help you win access — it can also improve your odds of picking winners.

If you have the capital and the knowledge but lack the personal network, you could explore angel investing platforms like FundersClub and AngelList. These sites offer curated deal flow for accredited investors and let you invest smaller amounts across multiple startups.

That said, proceed with caution. Many of the deals listed on these platforms have already been passed over by top-tier VCs — often for good reason. The deal quality on them can be quite low.

3. Invest in pre-IPO & venture capital funds

If you're not accredited — or simply don't want to pick individual startups — you can invest in funds that handle it for you.

Here are a few options:

- Fundrise Innovation Fund: Fundrise, best known as a real estate crowdfunding platform, also offers the Innovation Fund. The fund invests in private, high-growth tech companies and holds stakes in OpenAI, Anthropic, Anduril Industries, Canva, Databricks, and more. The Innovation Fund is open to all investors, and the minimum investment is just $10.

- ARK Venture Fund: The ARK Venture Fund invests in disruptive technology companies in both the public and private markets. Its top five holdings are SpaceX, Figure AI, OpenAI, Epic Games, and Lambda Labs. The fund has an expense ratio of 2.90% and is open to all investors.

- Public VC firms: You can invest in publicly traded VC firms like Blackstone (BX) and investment holding companies like SoftBank Group (SFTBY) straight from your brokerage account. These are billion-dollar companies with stakes in many private companies.

- Private equity ETFs: You can buy private equity ETFs like Invesco's (PSP) or ProShares's (PEX). Both of these ETFs are actively managed and have expense ratios of 1.80% and 2.99%, respectively.

Important: each of these investments is available to all investors, not just accredited investors.

4. Make indirect investments

Another way to get exposure to pre-IPO startups is by investing in public companies that already own stakes in them.

Here are a few examples:

- Disney (DIS) owns 100% of Hulu. While you can't invest in Hulu directly, owning Disney stock gives you indirect exposure.

- Salesforce (CRM) participated in Databricks' Series G in 2021. Assuming a $200 million investment, its stake would be worth around $460 million today.

- Microsoft (MSFT) has invested $13 billion into OpenAI and owns 27% of the company.

The problem? These pre-IPO investments usually represent a tiny fraction of the public company's overall business.

Salesforce's $460 million Databricks stake, for example, is just 0.19% of its $245 billion market cap. Even if Databricks were to 10x, it would barely move the needle on Salesforce's stock price.

That said, if you already own these stocks or believe in the parent companies, these small stakes can offer some optionality on high-growth startups — just don't expect them to drive performance on their own.

5. Invest on the IPO date via your broker

In the hours leading up to an IPO, some brokerages offer a limited allocation of shares to their clients—before the stock begins trading on public exchanges.

These shares are typically priced at the IPO offering price, which is set in advance of the first day of trading. If demand is high, buying at this price can be extremely profitable.

For instance, Figma (FIG) reached a high of $124 per share on its opening day, more than 275% above its offering price of $33.

I've seen IPO offerings on TradeStation, Robinhood, Webull, TD Ameritrade, Schwab, and Fidelity. But availability is limited, and most brokers prioritize clients with larger account balances or higher trading activity.

If you're a customer, your broker will typically notify you if you qualify for an upcoming IPO allocation.

Just keep in mind: demand often far exceeds supply, and even eligible investors may only receive a small portion of their requested shares.

Can anybody invest in shares of pre-IPO stock?

Yes, anybody can invest in shares of pre-IPO stock, though the type of investment varies.

Accredited investors can get direct exposure to private companies by buying shares on a secondary marketplace.

Accreditation requirements

It's easy to see if you qualify as an accredited investor. You only need to meet one of the following criteria:

- Have an annual income of $200,000 individually or $300,000 jointly.

- Have a net worth that exceeds $1,000,000 (excluding your main residence).

- Be a qualifying financial professional (have a Series 7, 65, or 82 license).

If any of those apply, you qualify.

Angel investors can also get direct exposure to companies, though they need personal connections and millions of dollars of capital.

On the other hand, anyone can invest in certain privately-held venture funds (like Fundrise's Innovation Fund or the ARK Venture Fund), though you can't get direct exposure to individual companies. Retail investors can also get indirect exposure by investing in publicly-traded funds or companies that own shares of private companies.

So, while there are ways for everyone to invest in private companies, the best and most direct methods are still reserved for investors with the most money and connections.

How to evaluate a pre-IPO investment

Unlike public companies, private startups aren't required to disclose financials — making them much harder to evaluate.

At best, you might get access to a pitch deck with selective financial metrics or find an interview of the founder. But even then, the level of detail pales in comparison to what public companies are required to report.

Many basic questions are hard to answer, like what the company does, who it sells to, what the vision is, and how it stacks up against competitors.

In many cases, there simply isn't enough information to build a fully informed, numbers-driven analysis. You're left piecing together fragments to form a thesis.

That's why evaluating pre-IPO startups relies heavily on qualitative judgment. You're betting on the team, the market, the timing, and then forming a narrative about how it all comes together.

Angel investor Julia DeWahl has developed a personal framework for assessing early-stage deals. She asks these 6 questions:

- Why is this the team to build a winning company in this space?

- How deep and specific is the customer pain/need?

- How will this company acquire customers?

- What's the business model, and what are the advantages and risks of that model?

- Why now?

- What do you have to believe for this to grow into a huge business?

Once she answers those, she scores each deal by conviction and estimates the company's value five years out. Only the highest-potential ideas make it into her portfolio.

In short, pre-IPO investing isn't about spreadsheets and price targets. It's about identifying a story you believe in, and accepting you might be wrong.

Pros and cons of pre-IPO investing

| Pros | Cons |

| Potentially high returns | Highly speculative and risky |

| Diversification outside of traditional markets | Limited financial information |

| May require accreditation status and/or connections | |

| Limited liquidity, so you may have trouble selling your investment | |

| High capital requirements |

Final thoughts

Pre-IPO investing is more accessible than ever, but there are still changes.

Opportunities are limited, information is scarce, and the risk of loss is high. Many startups fail, and even those that succeed may take years to generate meaningful returns.

That said, every industry giant was once a private company. For investors who can identify winners early, the upside can be enormous.

If you choose to invest, do so with caution. Approach each deal with healthy skepticism, and treat it as one piece of a broader, diversified portfolio.

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited (“Hiive”) or any of its affiliates. StockAnalysis is not a broker dealer or investment adviser. This communication is for informational purposes only, and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investment involves risk, including the loss of principal and past performance does not guarantee future results. There is no guarantee that any statements or opinions provided herein will prove to be correct. StockAnalysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and member of FINRA / SIPC. Find Hiive on BrokerCheck.