How to Buy Cognition Stock in 2025

Cognition is an applied AI lab best known as the developer of Devin, an AI coding assistant that's been exploding in popularity.

Annual recurring revenue (ARR) from Cognition's core product surged from $1 million in September 2024 to $73 million in June 2025.

And investors have been piling in.

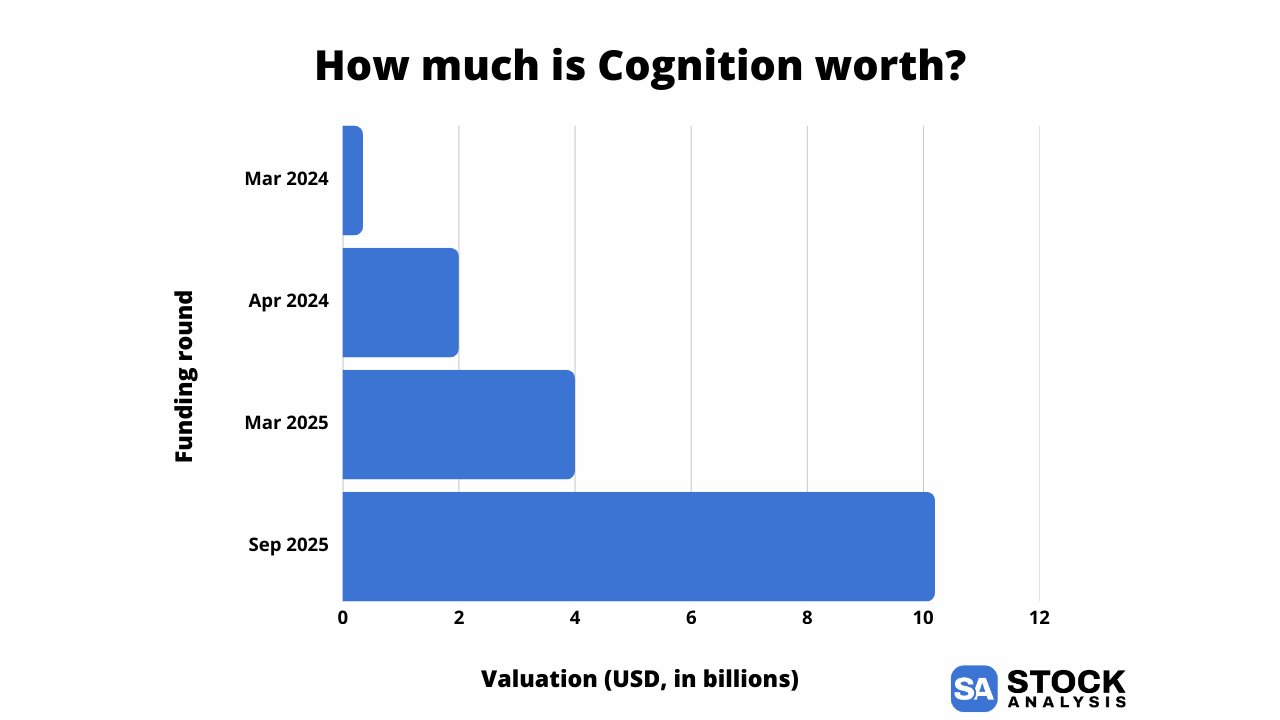

In September 2025 — less than two years after founding the company — Cognition raised $400+ million at a $10.2 billion valuation. This is up from the $4 billion it was valued at just six months earlier.

Here's how you can invest in it, too.

Can you buy Cognition stock?

Cognition is still a private company. There is no Cognition stock symbol, and it doesn't trade publicly on an exchange.

However, if you qualify, you can buy shares on a pre-IPO marketplace.

Hiive is an investment platform where accredited investors can buy shares of many of the world's hottest tech startups and VC-backed companies.

Accreditation requirements

It's easy to see if you qualify as an accredited investor. You only need to meet one of the following criteria:

- Have an annual income of $200,000 individually or $300,000 jointly.

- Have a net worth that exceeds $1,000,000 (excluding your main residence).

- Be a qualifying financial professional (have a Series 7, 65, or 82 license).

If any of these apply, you qualify. Just register with the platform below, and Hiive will verify your status.

As of the time of this writing, there are four live orders of Cognition stock available:

Most listings on Hiive are created by current or former employees who received stock options as part of their compensation. Some employees would rather receive cash for their shares so decide to list them on Hiive's platform.

After a listing is created, buyers can see the number of shares for sale, the asking price, and the implied valuation.

From there, buyers can place bids on certain lots of shares or add a company to their watchlist and get alerted to any new listings or transactions.

To see all of the bids, asks, and recent transactions of Cognition, plus the other 3,500+ companies listed on Hiive, you can create a free account with the button below:

Can retail investors buy Cognition?

There is no way for retail investors to invest in Cognition.

However, there are some ways to invest in Cognition's competitors, meaning other companies with AI coding tools.

Here are a few ideas:

- Replit is also a private company, but retail investors can get exposure to it via the ARK Venture Fund. The fund primarily invests in private technology companies and is available to retail investors via SoFi. Read more about buying Replit stock.

- Microsoft (MSFT) has GitHub Copilot, the most widely adopted AI coding assistant, built on OpenAI models. It integrates into VS Code and other IDEs to provide real-time code completions, explanations, and whole-function generation.

- Alphabet (GOOGL), Google's parent company, offers Gemini Code Assist, Google's coding assistant. It helps with code generation, debugging, and documentation inside Google Cloud and popular IDEs.

- Amazon's (AMZN) CodeWhisperer is AWS's answer to Copilot and is designed for developers building on its cloud. It generates code suggestions, flags security risks, and integrates tightly with AWS services for cloud-native development.

Additionally, AI labs OpenAI and Anthropic both have their own coding tools, powered by their LLMs. Both of these AI labs are private companies, but similar to Replit, there are options for retail investors to get exposure.

The ARK Venture Fund also owns stakes in OpenAI (2nd largest holding) and Anthropic (9th largest holding), and so does the Fundrise Innovation Fund — another private fund available to retail investors.

These labs also have close ties to the public companies listed above — OpenAI to Microsoft and Anthropic to Amazon and Google. For more information, see our articles on investing in OpenAI and investing in Anthropic.

Still, none of these options is the same as investing in Cognition. If you're only interested in investing in it, you will have to wait for its IPO.

When will Cognition go public?

Cognition CEO Scott Wu has not made any indication of plans to take the company public, though that certainly appears to be the path that it's on.

The company just completed its Series D in September 2025, which means it's likely at least 1–2 rounds away from being a serious candidate for an IPO.

That would put its IPO at the beginning of 2027, at the earliest (by my estimation).

If it does go public, you'll need a brokerage account to buy it. If you don't have a brokerage account, we recommend Public.

On Public, you can invest in stocks, ETFs, bonds, Treasuries, and crypto, all on one of the most modern investing platforms.

What is Cognition, and what does it do?

Cognition was founded in November 2023 by Scott Wu, Walden Yan, and Steven Hao, all of whom were competitive programmers who won gold medals at the International Olympiad in Informatics. They initially focused on crypto before pivoting to AI.

Cognition launched Devin, its AI-powered coding tool, in March 2024.

Unlike most competitors, who focus on assisting or accelerating human developers, Devin is known for autonomously performing software engineering tasks. For this reason, Cognition presents it as an “AI software engineer.”

All of these tools still have some limitations and reliability issues, though their effectiveness as coding assistants has led to substantial revenue and investor interest.

In the 18 months since Devin's launch, the company has raised $1.1 billion over four rounds and, with help from its acquisition of Windsurf (more on this below), is now generating more than $150 million in ARR.

Work culture at Cognition

Cognition has built a reputation as being a demanding place to work.

In July 2025, Cognition acquired Windsurf, an AI-coding startup, just days after Google poached Windsurf's CEO and other key members of its team.

Three weeks after the acquisition, Cognition laid off 30 Windsurf employees and sent an email to the remaining 200 offering buyouts equivalent to nine months' salary.

In the email, CEO Scott Wu made it clear that those who chose to stay would be required to participate in the company's 80-hour, 6-day workweeks.

“We don't believe in work-life balance — building the future of software engineering is a mission we all care so deeply about that we couldn't possibly separate the two,” Wu wrote.

The long-term impact of this approach on the business is not yet clear; for example, if more demanding work days may lead to employee burnout and retention issues.

That said, as evidenced by the buyout offer, current leadership seems to be actively working to staff the company with individuals who support its mission and approach.

How much is Cognition worth?

Cognition most recently raised $400+ million at a $10.2 billion valuation in September 2025 — about 2.5x the $4 billion valuation it had received just six months earlier.

In total, the company has raised $1.1 billion over four rounds.

Its main backers include Peter Thiel's Founders Fund, Lux Capital, and Joe Lonsdale's 8VC. Bain Capital Ventures, Hanabi Capital, and D1 Capital also participated in the September 2025 round.

Here's a look at how Cognition's valuation has changed over time:

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited (“Hiive”) or any of its affiliates. StockAnalysis is not a broker dealer or investment adviser. This communication is for informational purposes only, and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investment involves risk, including the loss of principal and past performance does not guarantee future results. There is no guarantee that any statements or opinions provided herein will prove to be correct. StockAnalysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and member of FINRA / SIPC. Find Hiive on BrokerCheck.