6 Ways to Invest in OpenAI (ChatGPT)

OpenAI is in build mode.

In September 2025, the artificial intelligence lab inked a deal with NVIDIA that will enable it to deploy 10 gigawatts of data center capacity supported by 4–5 million of the chipmaker's GPUs.

NVIDIA also agreed to invest up to $100 billion in OpenAI, giving it a financial stake in one of its most important customers.

The partnership cements the bond between two of the biggest forces driving the AI boom.

In October 2025, OpenAI was valued at $500 billion in a secondary share sale, making it the most valuable private company in the world (and surpassing SpaceX).*

*It also restructured later in the month, paving the way for a potential $1 trillion IPO. More on this below.

This valuation comes just seven months after it raised $40 billion at a $300 billion valuation — the largest private tech funding round ever.

As of August, ChatGPT had 700 million weekly users and the company was generating more than $12 billion in annualized revenue — both more than double since the start of the year.

How OpenAI got here

In November 2022, OpenAI released ChatGPT, an AI chatbot based on a large language model (LLM) that generates detailed and human-like responses to user queries.

ChatGPT went viral, reaching 100 million users in just two months, the fastest product to ever reach the milestone (at that time).

OpenAI's launch of ChatGPT — and its associated API — has ushered in a new wave of development in artificial intelligence all over the world.

Regardless of where AI goes from here, it's hard to imagine OpenAI won't play a prominent role, which is probably why you're wondering how to invest in it.

Here's how.

How to invest in OpenAI

OpenAI is not a public company, which means there is no OpenAI stock symbol, and it cannot be bought in your typical brokerage.

But you don't need to wait for its IPO to gain exposure to OpenAI and ChatGPT.

Here are six ways to invest in OpenAI stock today, while it's still a private company.

1. Buy shares from current shareholders

Hiive is a secondary marketplace where accredited investors can buy shares of private, VC-backed startups.

Accreditation requirements

To qualify as an accredited investor, you must meet one of the following criteria:

- Have an annual income of $200,000 individually or $300,000 jointly.

- Have a net worth that exceeds $1,000,000, excluding your primary residence.

- Be a qualifying financial professional with a Series 7, 65, or 82 license.

SpaceX, Figure AI, and Cerebras Systems are a few of the most active companies on Hiive. In all, there are more than 3,000 private companies listed on the site.

Hiive works by connecting current shareholders (typically employees, venture capital firms, or angel investors) to accredited investors. After a buyer and seller agree on a price, Hiive facilitates the transaction.

However, because of its legal structure, OpenAI's shares cannot be purchased directly. Instead, external investors must invest through a special-purpose vehicle (SPV), a more flexible fundraising structure that's relatively common in private equity.

For this reason (I believe), Hiive has a placeholder for OpenAI's shares but does not show any shares available for purchase on its platform. However, I think Hiive has an alternate route for investing in the company.

You can see what's available by registering for free with the button below:

2. Invest via the Fundrise Innovation Fund

The Fundrise Innovation Fund is a venture capital fund available to all investors that invests in private technology companies.

The fund's investment thesis is centered around a few themes: data infrastructure, real estate technology, machine learning, and artificial intelligence.

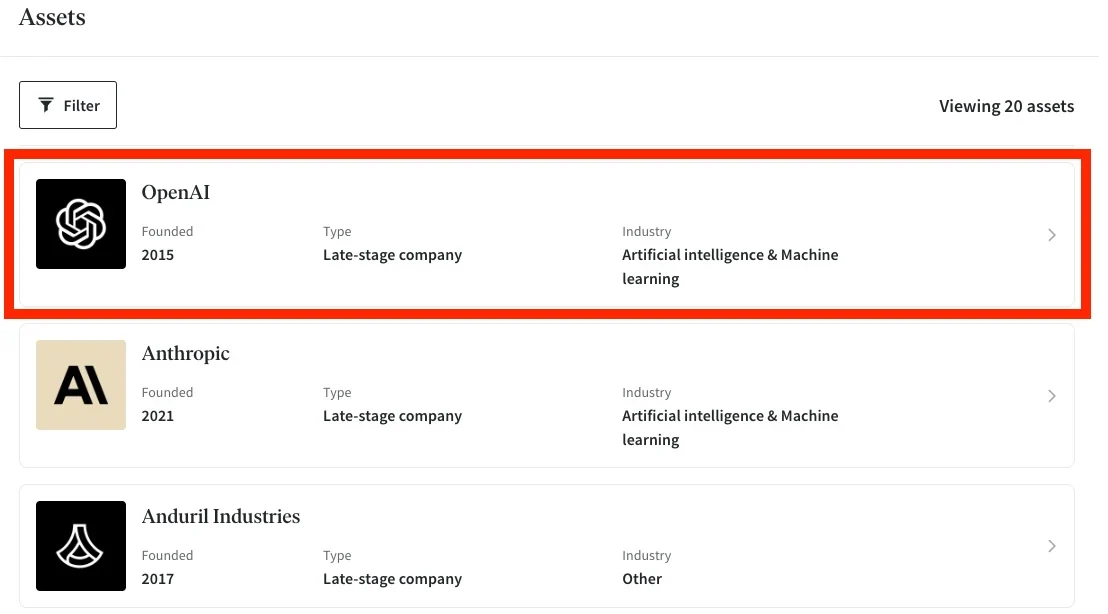

It currently owns stakes in 16 companies, including Anthropic, Databricks, Service Titan, Ramp, and OpenAI.

While OpenAI isn't listed publicly as one of the fund's holdings, it does show as a holding once you register and become an investor in the fund (see the image below from my investor account):

The fund has exposure to OpenAI through an SPV, which may prevent it from advertising the position to non-investors.

The Innovation Fund is open to all U.S. residents, has an annual management fee of 1.85%, and a minimum investment of just $10.

For more information about the fund, see my Fundrise Innovation Fund Review.

3. Invest via the ARK Venture Fund

The ARK Venture Fund is an actively managed fund that invests based on its theme of "disruptive innovation."

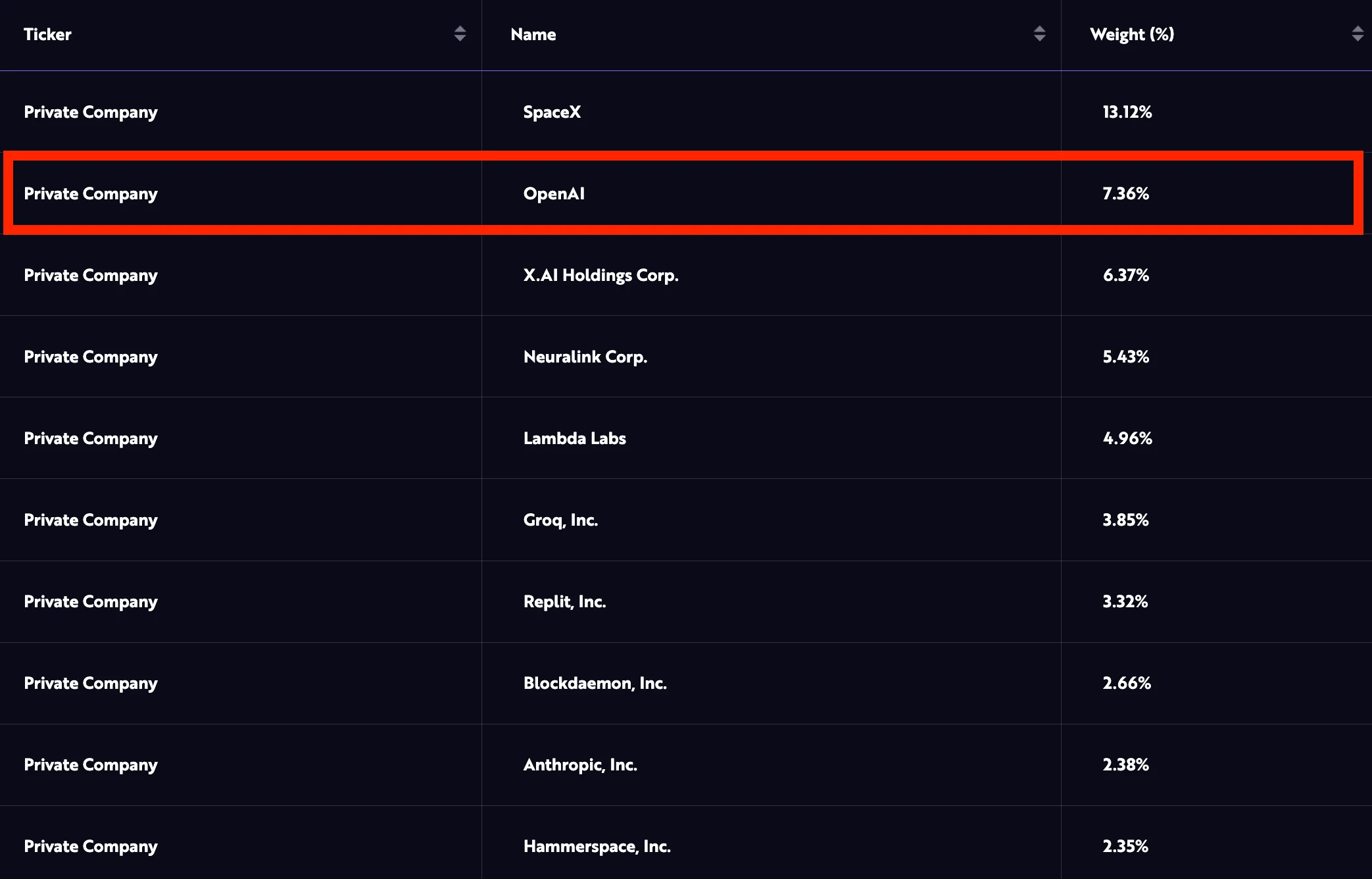

The fund invests in both public and private companies, though all of the top 10 holdings are private companies. At the time of this writing, OpenAI is the 2nd largest position at 7.36%:

Other companies in the fund's top 10 include SpaceX, xAI, Neuralink, Lambda Labs, and Anthropic.

The fund is available to all investors and has a 2.90% annual management fee. You can learn more about the fund and how to invest in it via the ARK website.

4. Invest indirectly (via Microsoft or NVIDIA)

OpenAI has strategic partnerships with Microsoft and NVIDIA.

Here are more details on both, and how an investment in either of these companies would give you indirect exposure to OpenAI.

Microsoft

Microsoft (MSFT) has invested in OpenAI on multiple occasions and has a unique relationship with the lab.

Here's the history:

- 2019: Microsoft made its first major investment in OpenAI, committing $1 billion.

- 2021: Microsoft quietly expanded the partnership with undisclosed additional investments and deeper integrations, including offering OpenAI's models through Azure OpenAI Service.

- 2023: Microsoft invested an additional $10 billion in a deal that included funding OpenAI's compute needs on Azure, securing a 49% share of OpenAI's profits up to an undisclosed cap, and having no control over OpenAI's governance.

- 2025: OpenAI's corporate restructuring gave Microsoft a 27% stake (plus bonuses).

Until recently, Microsoft's equity stake in OpenAI was not clearly defined, even in its SEC filings — it had never disclosed how much of the AI lab it owned or how much its stake was worth.

That changed in October 2025 when OpenAI restructured and moved away from its nonprofit roots (more on this below). As part of the restructuring, Microsoft received a 27% stake in the new for-profit entity (OpenAI Group PBC) worth $135 billion.

In addition to its equity stake, Microsoft will continue receiving roughly 20% of OpenAI's revenue and retain certain rights to OpenAI's products and underlying AI models.

Both arrangements will remain in effect until an independent panel verifies that OpenAI has achieved artificial general intelligence (AGI).

Microsoft also received a $250 billion cloud computing contract with OpenAI, though it agreed to give up its right of first refusal as the company's primary compute provider.

As mentioned above, Microsoft retained its right to embed OpenAI's models into its own products and services. Here's how it's currently incorporating the lab's technology:

- Copilot: Microsoft integrated OpenAI's GPT models into Copilot tools across Word, Excel, Outlook, PowerPoint, and GitHub, transforming all of Microsoft's most popular apps into AI-enabled platforms.

- Azure OpenAI Service: Microsoft offers commercial access to OpenAI's models through Azure, charging businesses for cloud-based API usage.

- Bing and Edge: Microsoft's search engines are also powered by OpenAI's technology, which improves search results and answers user queries faster.

These product integrations have allowed Microsoft to charge premium prices for enhanced versions of its Office 365, GitHub, and Azure services, positioning itself as a real leader in personal and enterprise AI.

Altogether, Microsoft has invested $13.8 billion in OpenAI, meaning its stake has nearly 10x'd in value. Still, the investment makes up just 3.4% of Microsoft's $4 trillion market capitalization.

NVIDIA

While Microsoft has a long-standing relationship, perhaps the most practical way to get exposure to OpenAI's growth is through NVIDIA (NVDA).

The two companies are tightly bound: OpenAI relies on NVIDIA's GPUs to power its models, while NVIDIA benefits from being the hardware backbone of the leading AI lab. It's a natural pairing of best-in-class software and best-in-class hardware.

Their recent partnership cements this connection even further. NVIDIA has committed up to $100 billion to support OpenAI's expansion, which OpenAI will primarily use to lease 4–5 million NVIDIA GPUs.*

*For reference, NVIDIA is planning to ship 4–5 million GPUs total in 2025.

The $100 billion will be deployed in stages, $10 billion at a time, invested at OpenAI's valuation at the time of each investment.

While it's making a bold bet on OpenAI, the partnership means both revenue and an equity stake for NVIDIA.

Note: NVIDIA also participated in OpenAI's October 2024 round, which valued the company at $157 billion. It invested via convertible debt, however, and the exact terms are unknown.

5. Invest in other leading AI companies

There are other companies outside of Microsoft and NVIDIA you may be interested in, including an NVIDIA supplier.

Taiwan Semiconductor Manufacturing Company (TSMC)

TSMC (TSM) manufactures the advanced chips designed by companies like NVIDIA, giving it a critical role as the world's leading producer of the semiconductors powering AI infrastructure.

As NVIDIA attempts to double its GPU output, it may rely more and more heavily on TSMC.

More companies with AI exposure

Here are a few other tech companies with exposure to AI:

- Alphabet (GOOG, GOOGL): Google has invested heavily in AI for years and may be the biggest beneficiary of AI-powered search. Their Gemini (formerly Bard) chatbot is also one of the biggest competitors to ChatGPT, plus the Google Cloud Platform will likely be running a lot of AI applications in the future.

- Amazon (AMZN): Amazon runs Amazon Web Services (AWS), which is the world's biggest cloud computing provider. A lot of future AI computing is likely to be run on their servers.

- Meta Platforms (META): Meta's artificial intelligence lab (Meta AI) was launched in 2013. Since that time, Meta has poured billions of dollars into developing generative AI, computer vision, and human speech processing technologies.

There are also other private companies you may be interested in, such as Figure AI, Anthropic, and Scale AI.

6. Invest in exchange-traded funds

Instead of buying an individual stock, you may want to diversify across a broad range of companies focused on similar technology via an ETF:

- Roundhill Generative AI & Technology ETF (CHAT): This ETF invests in companies focused on generative AI, the same technology powering ChatGPT.

- ROBO Global Robotics & Automation ETF (ROBO): This fund buys companies from around the world that are focused on robotics and automation.

- First Trust Nasdaq Artificial Intelligence and Robotics ETF (ROBT): This is another global fund focusing on artificial intelligence and robotics companies.

- Global X Robotics & Artificial Intelligence ETF (BOTZ): This fund focuses on companies involved in the development and production of robots or AI.

- iShares Exponential Technologies ETF (XT): This iShares fund invests in disruptive information technology companies.

While none of these ETFs owns OpenAI, they will give you general exposure to the artificial intelligence industry.

Don't have a brokerage account?

If you don't have a brokerage account, check out our overview of the 7 best brokerage accounts in 2025. Spoiler: We like Public.

When will OpenAI IPO?

The only way for retail investors to buy shares of OpenAI directly is if it goes public, which may be coming sooner than previously expected.

In September 2025, when asked about a potential IPO, CEO Sam Altman said, "I assume that someday we will be a public company… For now, we're certainly able to raise a lot of capital in private markets."

But just one month later, in a livestream announcing the company's restructuring, Altman said a public offering was the most likely path forward given the company's massive funding requirements.

Just three days after the announcement, rumors broke that OpenAI was laying the groundwork for a $1 trillion IPO that may be coming as soon as the second half of 2026.

The rapid shift in sentiment and IPO preparations signal a new urgency inside OpenAI to access public markets. As a public company, it could more easily issue new stock and debt to help finance Altman's plans to pour trillions of dollars into AI infrastructure.

When it does go public, you'll need a brokerage account to buy stock. If you don't have a brokerage account, we recommend Public.

OpenAI's corporate restructuring

In October 2025, OpenAI completed a corporate restructuring in a move that freed itself from its nonprofit roots.

The for-profit segment — the part that has attracted all external investment and carries the $500 billion valuation — was converted into a public benefit corporation (PBC) called OpenAI Group PBC.

The original nonprofit entity, now renamed the OpenAI Foundation, retained legal control and now holds a 26% stake worth $130 billion.

Under the new structure, Microsoft owns 27%, the OpenAI Foundation owns 26%, and the remaining 47% is held by investors and employees.

This restructuring removes major constraints on OpenAI's ability to raise capital.

Before, OpenAI operated as a nonprofit bound by strict equity restrictions — a structure that became increasingly unsustainable as its funding needs grew.

In April, SoftBank agreed to invest $30 billion, contingent on OpenAI's successful transition to a for-profit entity.

It also paves the way for a future IPO, a likely step given the company's $1.4 trillion in obligations to finance the largest collective data center buildout in history.

OpenAI's infrastructure projects

OpenAI's deal with NVIDIA comes several months after the announcement of the Stargate Project, a joint venture between OpenAI, Oracle, and SoftBank that could include up to $500 billion of investments in AI infrastructure.

In total, OpenAI has announced commitments to build 30 gigawatts of infrastructure.

NVIDIA CEO Jensen Huang has estimated that building one gigawatt of data center capacity costs between $50 and $60 billion, of which about $35 billion of that is for NVIDIA chips and systems.*

*Much of NVIDIA's $100 billion investment in OpenAI will be used to lease NVIDIA GPUs, raising concerns over the circular nature of the deal.

For perspective, 30 gigawatts of data center capacity would consume as much electricity as sixteen Hoover Dams generate in a year — enough to power about 25 million U.S. homes.

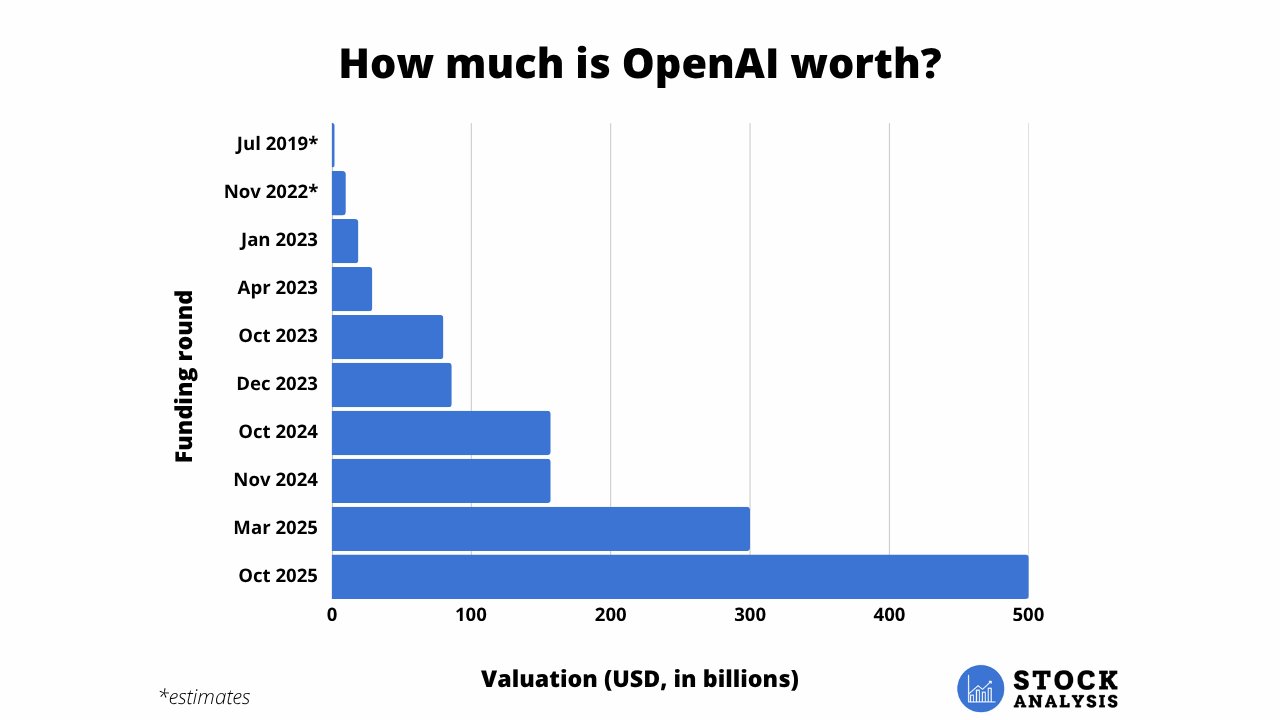

How much is OpenAI worth?

In October 2025, OpenAI was valued at $500 billion in a secondary share sale in which current and former employees sold roughly $6.6 billion worth of shares.

This was up from the $300 billion valuation it received in March 2025, which was nearly double the previous valuation of $157 billion (November 2024).

Here's a look at OpenAI's valuation history:

Its $500 billion valuation makes it the most valuable private company in the world.

Frequently asked questions

Below are a few more questions often asked about investing in OpenAI.

Who owns OpenAI stock?

OpenAI began with an initial seed funding of $50 million from Elon Musk, who was a co-founder of the company before leaving in 2018.

The lab has raised a total of $61.9 billion from 34 investors over 10 funding rounds.

Most recently, SoftBank, T. Rowe Price, Thrive Capital, and others purchased $6.6 billion worth of shares at a $500 billion valuation in October 2025.

Does Elon Musk own a stake in OpenAI?

While Elon Musk was a co-founder and originally invested $50 million to start the lab, he sold his stake to Microsoft and left the company in 2018.

Musk had reportedly committed $1 billion in support before pulling out over disagreements about the speed of OpenAI's advancements.

Since then, he has repeatedly criticized the lab for not placing enough emphasis on safe AI development and has recently filed a lawsuit claiming CEO Sam Altman breached their contract by abandoning their original mission to focus on profits.

In April 2023, Musk incorporated xAI, a rival AI firm that recently acquired X (formerly Twitter) and is valued at $113 billion.

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited (“Hiive”) or any of its affiliates. StockAnalysis is not a broker dealer or investment adviser. This communication is for informational purposes only, and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investment involves risk, including the loss of principal and past performance does not guarantee future results. There is no guarantee that any statements or opinions provided herein will prove to be correct. StockAnalysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and member of FINRA / SIPC. Find Hiive on BrokerCheck.

.png)