How to Buy X (Twitter) Stock in 2025

After being listed for nine years on the NYSE (under the ticker symbol TWTR), Elon Musk took Twitter private for $44 billion in April 2022.*

*The deal closed in April 2022, but Twitter was not delisted until October 2022.

Following the acquisition, Musk fired many top executives, laid off 75% of the company's staff, and launched a subscription service for $8/month, all in an effort to reach profitability.

In mid-2023, with the business nearly breaking even, 50 of its top 100 U.S. advertisers stopped advertising on Twitter (which had been rebranded as X in July 2023), citing concerns over brand safety and content moderation issues.

Revenue cratered. In Q2 2024, X generated just $114 million in revenue in the U.S., down 84% from the same quarter two years earlier.

By September 2024, Fidelity valued X at less than $10 billion, 79% lower than Musk's takeover price.

However, in the months following President Trump's reelection that November, advertisers came back to the platform, and the company was reportedly once again valued at $44 billion.

xAI acquires X

Then, in March 2025, Musk announced that his AI startup, xAI, had acquired X in an all-stock deal that valued xAI at $80 billion and X at $33 billion (a $45 billion valuation less $12 billion in debt).

Musk described the two companies' futures as "intertwined" and that the acquisition will help them "combine the data, models, compute, distribution, and talent.”

xAI's stated mission is to prevent the spread of misinformation. Its one live product, Grok, is an AI chatbot integrated with X and is only available to X's Premium+ subscribers.

X is now a wholly owned subsidiary of xAI, which means the only way to get exposure to X is by investing in xAI.

And while xAI is a private company, there is a way for you to invest in it — if you qualify.

Can you buy X (Twitter) stock?

X (Twitter) is a private company that is fully owned by xAI. xAI is also a private company, so there's no way to buy stock in your traditional brokerage account.

However, xAI's shares are available on Hiive.

Hiive is an investment marketplace where accredited investors can buy shares of private companies from existing shareholders.

Accreditation requirements

It's easy to see if you qualify as an accredited investor. You only need to meet one of the following criteria:

- Have an annual income of $200,000 individually or $300,000 jointly.

- Have a net worth that exceeds $1,000,000 (excluding your main residence).

- Be a qualifying financial professional (have a Series 7, 65, or 82 license).

If any of these apply, you qualify. Just register with the platform below, and Hiive will verify your status.

Accredited investors can invest in more than 2,000 venture-backed companies on Hiive, including each of Musk's privately held companies:

At the time of this writing, there are 75 live orders of xAI stock available:

xAI is currently trading for $117.08 per share.

Each listing on Hiive is made by an existing shareholder who may be a current or former employee, a venture capital firm, or an angel investor.

Each seller sets their own asking price and quantity of shares available. From there, accredited buyers can accept a seller's asking price as listed, place bids, or simply add a stock to their watchlist.

To see all the bids, asks, and recent transaction data for X (and every other company on Hiive), you can register for a free account with the button below:

Can retail investors buy X stock or xAI stock?

Unfortunately, since X is owned by xAI (a private company), there's no way for retail investors to buy stock.

Given Musk's propensity for keeping companies private, it seems unlikely he will be taking xAI public any time soon.

But retail investors can get exposure to X via the ARK Venture Fund.

The ARK Venture Fund

The ARK Venture Fund, run by Cathie Wood, invests in technology companies with the potential to disrupt industries.

The fund had existing positions in both xAI and X prior to the acquisition in March. Its X shares were exchanged for shares in xAI as a result of the acquisition.

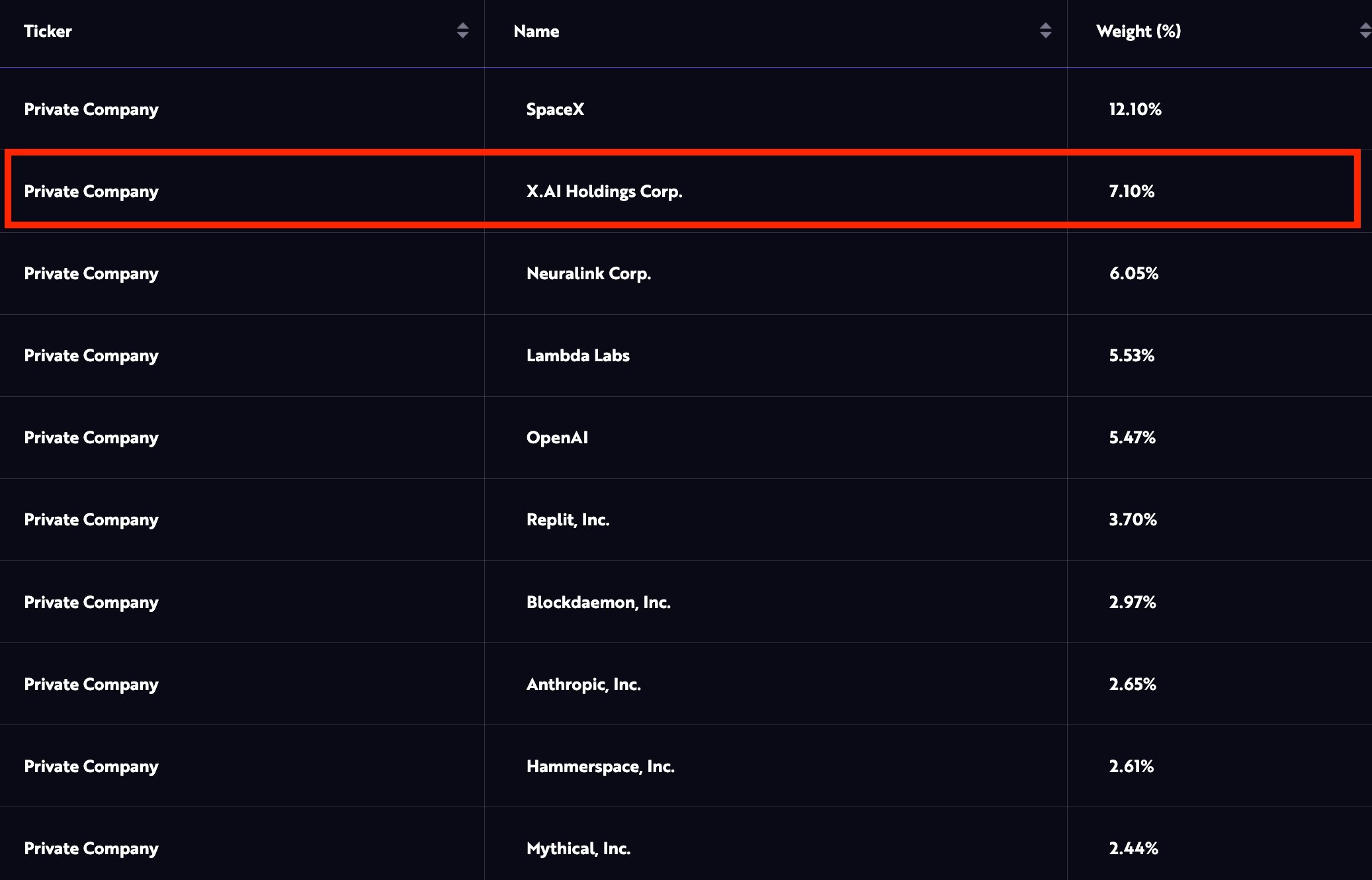

xAI makes up 7.10% of the fund, its second-largest position behind SpaceX:

Neuralink, OpenAI, and Anthropic are also in the fund's top 10 holdings.

The fund is available to all investors and has an annual expense ratio of 2.90%. You can learn more about how to invest on this page.

Alternatives to X

While you may not be able to invest in X, you can invest in a few of its publicly traded competitors.

- Meta Platforms (META) is the company behind Facebook, Instagram, and WhatsApp — three of the largest social media platforms. It also launched Threads, a direct competitor to Twitter, which recently hit 275 million monthly active users (MAUs)*. Meta generated revenue of $178.8 billion over the last year and is valued at $1.89 trillion.

- Snap (SNAP) is the parent company of Snapchat, the 9th largest social network with 800 million MAUs. The company has a market capitalization of $15.2 billion on TTM revenue of $5.5 billion.

- Pinterest (PINS) combines social media with e-commerce and advertising. It has about 500 million MAUs, generated TTM revenue of $3.8 billion, and has a market cap of $25.5 billion.

- Reddit (RDDT), which became publicly traded in March 2024, is a digital community website. The company generated revenue of $1.7 billion over the last 12 months and is valued at $35.3 billion.

*See companies' key business metrics — like user growth, revenue segmentation, and more — with our Metrics pages. Check out Meta's metrics here.

You may also be interested in Alphabet (GOOGL), the parent company of Google and YouTube; Microsoft (MSFT), which owns LinkedIn; and ByteDance, which owns TikTok.

How much is xAI worth after acquiring X?

xAI was valued at $80 billion in its acquisition of X in March 2025, giving the combined entity a valuation of $113 billion.

However, these were internal valuations, and it was unclear if the new company would be valued the same way by external investors.

Those questions were answered in July 2025 when Musk announced xAI would be seeking a valuation of up to $200 billion in its next funding round.

If it does, that would make it the 4th most valuable private company in the world.

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited (“Hiive”) or any of its affiliates. StockAnalysis is not a broker dealer or investment adviser. This communication is for informational purposes only, and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investment involves risk, including the loss of principal and past performance does not guarantee future results. There is no guarantee that any statements or opinions provided herein will prove to be correct. StockAnalysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and member of FINRA / SIPC. Find Hiive on BrokerCheck.