Altria Group, Inc. (FRA:PHM7)

Germany

· Delayed Price · Currency is EUR

Germany

· Delayed Price · Currency is EUR | Market Cap | 93.92B |

| Revenue (ttm) | 17.25B |

| Net Income (ttm) | 7.46B |

| Shares Out | n/a |

| EPS (ttm) | 4.40 |

| PE Ratio | 12.59 |

| Forward PE | 11.92 |

| Dividend | 3.73 (6.59%) |

| Ex-Dividend Date | Jun 16, 2025 |

| Volume | 372 |

| Average Volume | 5,937 |

| Open | 56.52 |

| Previous Close | 56.18 |

| Day's Range | 56.50 - 56.66 |

| 52-Week Range | 44.75 - 56.66 |

| Beta | n/a |

| RSI | 70.44 |

| Earnings Date | Jul 30, 2025 |

About Altria Group

Altria Group, Inc., through its subsidiaries, manufactures and sells smokeable and oral tobacco products in the United States. The company offers cigarettes primarily under the Marlboro brand; large cigars and pipe tobacco under the Black & Mild brand; moist smokeless tobacco and oral tobacco products under the Copenhagen, Skoal, Red Seal, and Husky brands; oral nicotine pouches under the on! brand; and e-vapor products under the NJOY ACE brand. It sells its products to distributors, as well as large retail organizations, such as chain stores. ... [Read more]

Financial Performance

In 2024, Altria Group's revenue was $20.44 billion, a decrease of -0.28% compared to the previous year's $20.50 billion. Earnings were $11.24 billion, an increase of 38.49%.

Financial numbers in USD Financial StatementsNews

Can $10,000 in Altria Group Stock Turn Into $20,000 by 2030?

A $10,000 investment in Altria stock five years ago would have more than doubled your money. Can the stock repeat that performance?

My Top 10 High-Yield Dividend Stocks For August 2025: One Yields 11%-Plus

I focus on dividend stocks with sustainable payouts to maximize risk-adjusted returns and avoid dividend cuts. My August 2025 picks—like Deutsche Post, Altria, Verizon, and PepsiCo—offer attractive yi...

August Dividend Kings: 3 Ideal Buys In 25 'Safer' Of 50 Dogs

Many Dividend Kings are overvalued, but seven top-yielding names now offer fair pricing, with annual dividends from $1,000 invested exceeding share prices. Analyst forecasts suggest select Dividend Ki...

Explore The Power Of Compounding With Big Dividends; Yields +6%

Great things require time and patience; so does wealth building. Compound interest, the "eighth wonder of the world", can quietly do the work for you. We discuss our time-tested dividend growth picks ...

Dividend Harvesting Portfolio Week 231: $23,100 Allocated, $2,461.19 In Projected Dividends

Despite a tough week for markets, I remain bullish and continue to buy dips, expecting a multi-year bull market fueled by AI and robotics. My Dividend Harvesting Portfolio's diversification helped mit...

Trading Near Its 52-Week High, Is Altria Stock a Good Buy Right Now?

Altria's stock hasn't traded at these levels since 2018.

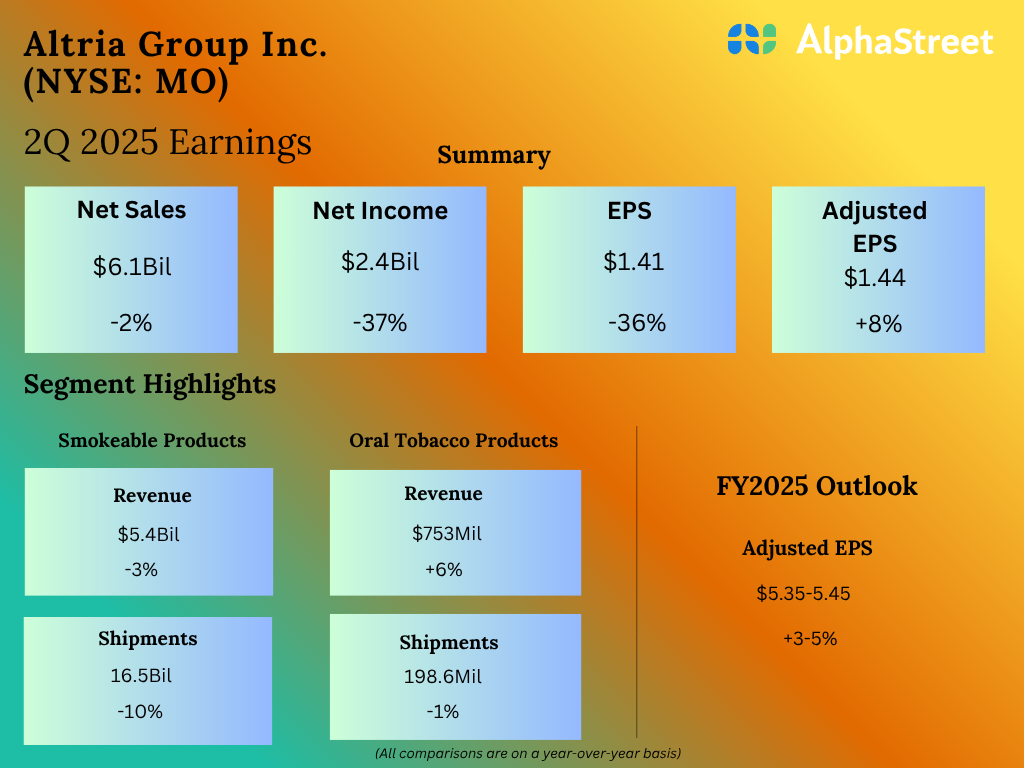

Oral tobacco products continue to be a growth driver for Altria (MO)

Shares of Altria Group, Inc. (NYSE: MO) stayed green on Tuesday. The stock has gained 19% year-to-date. The tobacco company saw revenues decline in the second quarter of 2025, weighed […] The post Ora...

Altria: Strong Dividend But Limited Upside

Altria Remains A Sin Giant

Altria Hits Six-Year High as Earnings Rise 8 Percent Despite Revenue Drop

Altria Group Inc. is the notorious tobacco giant formerly known as Philip Morris. The renamed brand recently reached a six-year high in share price, which is quite an unusual accomplishment for a high...

Correction Alert: 3 Popular Stocks Due For A Sharp Pullback

Blue-chip dividend stocks are great for compounding wealth, but valuation discipline is crucial for strong returns. I discuss 3 popular blue-chip dividend stocks that are due for a sharp pullback. I'm...

Altria Group: Raised EPS Guidance, Exciting For The Next Potential Dividend Increase

Altria Group offers a 6.6% yield, 55 years of dividend growth, and strong Q2 results. Click here to find out why I remain bullish on MO stock.

Altria Has a Big Dividend Yield, but Is It Sustainable?

Earnings are rising due to price increases, but volumes have been plummeting.

My 3 Favorite Stocks to Buy Right Now

Opendoor, Altria, and MercadoLibre are all solid investments in this bull market.

Altria: The Highest Yielding Tobacco Stock

Altria remains a buy for me due to its industry-leading dividend yield and potential for double-digit total returns, despite recent price appreciation.

Fast Money: MO, SEP, BUD, DHI

The final trades of the day with CNBCs Melissa Lee and the Fast Money traders.

Altria Among 6 Dividend Kings To Announce Annual Payout Increases In August

The More It Underperforms, The More I Buy

Investors are increasingly giving up on these laggards. However, I am seeing an enormous disconnect forming between price and value. As a result, the more these opportunities underperform, the more I ...

This Dividend King’s Stock Just Soared to a 6-Year High

Altria stock hit a six-year high because its earnings were strong and because this Dividend King has among the highest yields of S&P 500 stocks. The post This Dividend King’s Stock Just Soared to a 6-...

Dividend Harvesting Portfolio Week 230: $23,000 Allocated, $2,428.39 In Projected Dividends

The Dividend Harvesting Portfolio hit new milestones: $30,000 balance, 30%+ ROI, and $2,428 in forward annualized dividend income. Strong earnings season and potential Fed pivot in September could fur...

Altria: The Tricky Things About The Dividend

Buy 9 Barron's Better Bets (Than T-Bills) From 16 'Safer' July DiviDogs

Nine of the top sixteen Barron's Better Bets 'Safer' dividend dogs are attractively priced, offering dividends from $1K invested exceeding their share price. Analyst projections suggest 18-29% net gai...

Altria Group, Inc. (MO) Q2 2025 Earnings Call Transcript

Altria Group, Inc. (NYSE:MO) Q2 2025 Earnings Conference Call July 30, 2025 9:00 AM ET Company Participants Mac Livingston - Vice President of Investor Relations Salvatore Mancuso - Executive VP & CF...

Altria Packs Stronger Punch With Upgraded 2025 Outlook

Shares of Altria Group, Inc. (NYSE: MO) are trading higher on Wednesday after the cigarette company reported second-quarter adjusted earnings per share of $1.44, beating the analyst consensus estimat...