Brookfield Infrastructure Partners L.P. (TSX:BIP.UN)

Canada

· Delayed Price · Currency is CAD

Canada

· Delayed Price · Currency is CAD | Market Cap | 20.68B |

| Revenue (ttm) | 30.54B |

| Net Income (ttm) | 7.19M |

| Shares Out | n/a |

| EPS (ttm) | 0.02 |

| PE Ratio | 2,877.94 |

| Forward PE | 23.52 |

| Dividend | 3.13 (6.86%) |

| Ex-Dividend Date | May 30, 2025 |

| Volume | 607,048 |

| Average Volume | 425,003 |

| Open | 45.17 |

| Previous Close | 44.48 |

| Day's Range | 44.18 - 45.82 |

| 52-Week Range | 36.57 - 50.46 |

| Beta | 1.02 |

| RSI | 68.65 |

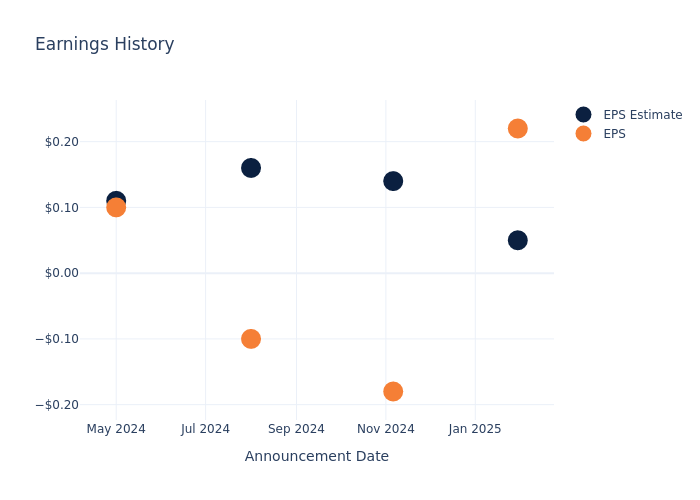

| Earnings Date | May 2, 2025 |

About TSX:BIP.UN

Brookfield Infrastructure Partners L.P. engages in the utilities, transport, midstream, and data businesses. The Utilities segment operates approximately 2,900 kilometers (km) of electricity transmission lines; 3,900 km of natural gas pipelines; 8.4 million electricity and natural gas connections; 0.7 million long-term contracted sub-metering services; and 2.8 million meters under management. This segment also offers cooling, water heaters, solar, and energy storage solutions; gas distribution; heating, ventilation, air conditioner, and water p... [Read more]

Financial Performance

In 2024, TSX:BIP.UN's revenue was $21.04 billion, an increase of 17.33% compared to the previous year's $17.93 billion. Earnings were $34.00 million, a decrease of -60.92%.

Financial numbers in USD Financial StatementsNews

Important Warning For Utility Stocks: 2 Major Risks You Need To See Before Buying

Utilities have outperformed the market—here's why that trend could suddenly reverse. Warren Buffett issued a chilling warning about utilities—investors should take notice. We share our current outlook...

Bullish call for dividend growth stocks

David Bahnsen, CIO at The Bahnsen Group, discusses earnings season and shares his top stock picks: IBM, Texas Instruments and Brookfield Infrastructure.

Dividend Stocks That Beat The Market - With Less Risk

Higher returns typically come with higher risk. But there are some rare exceptions. I present two high yielding dividend stocks that have the potential to earn higher returns with lower risk.

Retiring In A Permanent Tariff Era, My Top 2 Picks

Tariffs have become the new constituency of "higher-for-longer" scenario. It is hard to imagine how we could revert back to the same tariff levels that were in force before Trump took the Office. All ...

Brookfield Infrastructure: Investment Grade Securities For 64 Cents On The Dollar

Brookfield Infrastructure grew its fiscal 2025 Q1 FFO by 4 cents, supported by recession-resistant assets and a 5.55% dividend yield. Learn why BIP stock is a hold.

Brookfield Infrastructure: Why It Is One Of The Best Retirement Picks

Brookfield Infrastructure (BIP) is a top choice for defensive income investors, offering durability, safety, and value amid market uncertainty. Read more here.

The More It Tanks, The More I Say Thanks

We discuss Warren Buffett's secret to getting rich off of the stock market. Market panic is gifting dividend investors massive bargains—here are four steals to grab now. Find out why savvy investors c...

Brookfield Infrastructure Partners L.P. Limited Partnership Units (BIP) Q1 2025 Earnings Call Transcript

Brookfield Infrastructure Partners L.P. Limited Partnership Units (NYSE:BIP) Q1 2025 Earnings Conference Call April 30, 2025 9:00 AM ET Company Participants David Krant - Chief Financial Officer Dave...

Brookfield Weighs US Manufacturing Investment Following Tariffs

Brookfield Infrastructure Partners LP is looking to invest in US manufacturing operations as companies plan to build new plants following President Donald Trump’s tariff plans.

Brookfield Infrastructure Partners declares $0.43 dividend

Brookfield Infrastructure Reports Solid First Quarter 2025 Results

BROOKFIELD, News, April 30, 2025 (GLOBE NEWSWIRE) -- Brookfield Infrastructure Partners L.P. (Brookfield Infrastructure, BIP, or the Partnership) (NYSE: BIP; TSX: BIP.UN) today announced its results f...

Earnings Scheduled For April 30, 2025

Companies Reporting Before The Bell • Wabash National (NYSE: WNC) is expected to report quarterly loss at $0.28 per share on revenue of $409.85 million. • Timken (NYSE: TKR) is projected to report q...

A Preview Of Brookfield Infr Partners's Earnings

Brookfield Infr Partners (NYSE: BIP) is preparing to release its quarterly earnings on Wednesday, 2025-04-30. Here's a brief overview of what investors should keep in mind before the announcement. An...

3 Megatrends Are Creating A Once-In-A-Generation Boom For Infrastructure Stocks

Three major macro factors are causing a lot of turmoil in markets right now. Infrastructure is positioned to benefit from these three major macro factors. I share some specific picks for turning today...

A Golden Buying Opportunity For Big Dividend Growth Investors

Warren Buffett's “washtub moment” is here — are you ready to cash in? These 4 dividend-growth plays have big yields, impressive growth, and are poised to soar. Recession-resistant, inflation-resistant...

This High-Yield Stock Makes a Crown Jewel Acquisition

Brookfield Infrastructure just added another cash-cow asset to its empire.

Enough With 60/40, Consider 100% Dividend Strategy For Retirement

The 60/40 portfolio, with 60% in equities and 40% in bonds, has long been the gold standard in the investment game. Yet, it has failed to deliver on its promise. In my view, a durable income strategy ...

Why Most Dividend Retirement Strategies Fail: How To Retire With Dividends

Most high-yield strategies are ticking time bombs. Don't get wiped out when the next downturn hits. Discover the only portfolio blend that can deliver sustainable and rising dividends through inflatio...

Chris Blumas' Past Picks: CGI, Yum China & Brookfield Infrastructure Partners L.P.

Chris Blumas, portfolio manager at Raymond James Investment Counsel, discusses his past stock picks and how they're doing in the market today.

Leading Investor Criticizes 60/40 Portfolio: Why Our Approach Is Better

The traditional 60-40 strategy has failed to deliver meaningful returns during recent market cycles. We discuss why the 60-40 strategy may be structurally broken going forward. We share an approach th...

Ray Dalio Warns Of 'Something Worse Than A Recession' - Our Approach

Ray Dalio warns of something far worse than just a recession—here's how we're protecting our dividend portfolio. The assets we're buying to protect against a worst-case scenario. These real asset play...

Brookfield Infrastructure: Market Overreacting To Tariffs, High Yield Looks Like A Steal

The Market Is Crashing, But We Are Rejoicing

Why I'm celebrating this market crash—and loading up on these high-yield assets. Tariffs, recession fears, and falling interest rates: here's where smart money is going now. These overlooked stocks co...

Brookfield Strikes $9 Billion Deal For Colonial Pipeline—Shell Offloads Minority Stake

Shell PLC (NYSE: SHEL) shares are trading lower premarket on Friday. On Thursday, the company’s subsidiary, Shell Midstream Operating LLC, reached an agreement to sell its 16.125% stake in Colonial E...

Brookfield Buys Colonial Enterprises for $9 Billion

The equity investment in the oil-pipeline firm will be around $500 million, Brookfield said. The agreement includes buying Shell's 16.125% stake in the business.