Ovintiv Inc. (TSX:OVV)

Canada

· Delayed Price · Currency is CAD

Canada

· Delayed Price · Currency is CAD | Market Cap | 14.84B |

| Revenue (ttm) | 12.25B |

| Net Income (ttm) | 328.72M |

| Shares Out | n/a |

| EPS (ttm) | 1.25 |

| PE Ratio | 45.16 |

| Forward PE | 8.89 |

| Dividend | 1.68 (2.88%) |

| Ex-Dividend Date | Sep 15, 2025 |

| Volume | 151,596 |

| Average Volume | 343,702 |

| Open | 59.00 |

| Previous Close | 59.01 |

| Day's Range | 58.45 - 60.02 |

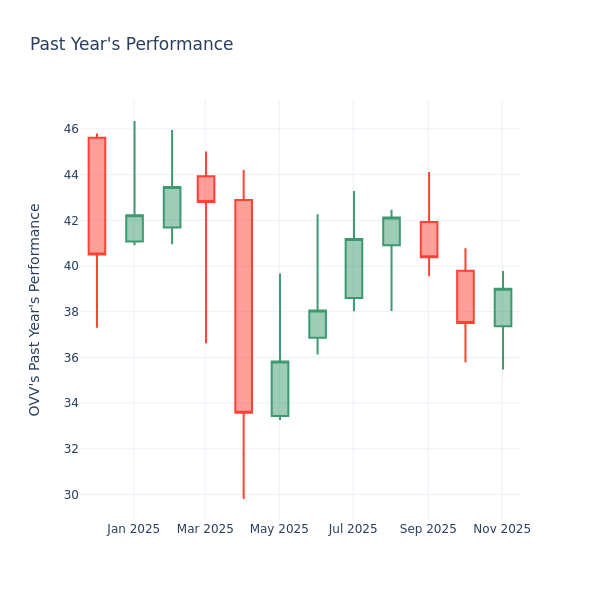

| 52-Week Range | 42.35 - 66.67 |

| Beta | 0.79 |

| RSI | 62.40 |

| Earnings Date | Mar 2, 2026 |

About Ovintiv

Ovintiv Inc., together with its subsidiaries, explores, develops, produces, and markets natural gas, oil, and natural gas liquids in North America. It has a portfolio of contiguous positions in the Permian and Anadarko basins, and the Montney. The company was formerly known as Encana Corporation and changed its name to Ovintiv Inc. in January 2020. Ovintiv Inc. was incorporated in 2020 and is based in Denver, Colorado. [Read more]

Financial Performance

In 2024, Ovintiv's revenue was $8.94 billion, a decrease of -16.11% compared to the previous year's $10.66 billion. Earnings were $1.13 billion, a decrease of -46.04%.

Financial numbers in USD Financial StatementsNews

APA, Coterra, Ovintiv started Outperform at William Blair, citing strong free cash flow

William Blair Initiates Coverage on Ovintiv (OVV) with Outperform Rating and $50 PT | OVV Stock News

William Blair Initiates Coverage on Ovintiv (OVV) with Outperform Rating and $50 PT | OVV Stock News

Ovintiv: Another Good Play In The Permian Basin, Adding Promising M&A Deals

OVV maintains a presence in Canada in the Montney Basin and in the US in the Permina Basin, taking advantage of the different royalty structure in each of the countries. The acquisition of NuVista Ene...

Here's How Much You Would Have Made Owning Ovintiv Stock In The Last 5 Years

Ovintiv (NYSE: OVV) has outperformed the market over the past 5 years by 11.79% on an annualized basis producing an average annual return of 25.06%. Currently, Ovintiv has a market capitalization of ...

Ovintiv: The Buying And Selling Continues

Ovintiv continues frequent portfolio shifts, shows strong operations, restores prior guidance and faces caution around recent deals. Learn why OVV stock is a sell.

Ovintiv (OVV) Receives a Boost as UBS Raises Price Target | OVV Stock News

Ovintiv (OVV) Receives a Boost as UBS Raises Price Target | OVV Stock News

Insider Decision Making Waves At Ovintiv: Maureen Rachel Moore Exercises Options, Realizing $30K

Maureen Rachel Moore , EVP at Ovintiv (NYSE: OVV), reported a large exercise of company stock options on November 20, according to a new SEC filing. What Happened: Moore, EVP at Ovintiv, exercised st...

Here's Why Investors Should Hold Onto Ovintiv Stock for Now

OVV's strong production, strategic acquisitions and firm liquidity support the stock even as commodity prices and leverage pressure its outlook.

Ovintiv (OVV) Analyst Rating Update: Citigroup Lowers Price Target | OVV Stock News

Ovintiv (OVV) Analyst Rating Update: Citigroup Lowers Price Target | OVV Stock News

P/E Ratio Insights for Ovintiv

Looking into the current session, Ovintiv Inc. (NYSE: OVV) shares are trading at $39.87, after a 2.74% spike. Moreover, over the past month, the stock went up by 8.42% , but in the past year, decreas...

Ovintiv (OVV) Shares Cross Above 200 DMA

In trading on Tuesday, shares of Ovintiv Inc (TSX: OVV.TO) crossed above their 200 day moving average of $55.11, changing hands as high as $55.53 per share. Ovintiv Inc shares are currently trading up...

If You Invested $100 In Ovintiv Stock 5 Years Ago, You Would Have This Much Today

Ovintiv (NYSE: OVV) has outperformed the market over the past 5 years by 14.81% on an annualized basis producing an average annual return of 28.54%. Currently, Ovintiv has a market capitalization of ...

Ovintiv Q3 Earnings Surpass Estimates, Revenues Decline Y/Y

OVV tops Q3 profit estimates as stronger gas prices and output offset weaker oil revenues and margins.

Ovintiv (OVV) Q3 2025 Earnings Call Transcript

Ovintiv (OVV) Q3 2025 Earnings Call Transcript

Ovintiv Inc (OVV) Q3 2025 Earnings Call Highlights: Strong Cash Flow and Strategic Acquisitions ...

Ovintiv Inc (OVV) Q3 2025 Earnings Call Highlights: Strong Cash Flow and Strategic Acquisitions Propel Growth

Q3 2025 Ovintiv Inc Earnings Call Transcript

Q3 2025 Ovintiv Inc Earnings Call Transcript

Ovintiv Inc. 2025 Q3 - Results - Earnings Call Presentation

Ovintiv Inc. (OVV) Q3 2025 Earnings Call Transcript

Investor Outlook: Ovintiv to buy NuVista Energy in $3.8B deal, marking return to Canadian oil patch

Ovintiv to acquire NuVista Energy in $3.8B deal, expanding in Alberta’s Montney as energy M&A accelerates and U.S. investment returns to Canada.

Ovintiv (OVV) to Acquire Nuvista Energy in C$18 per Share Deal

Ovintiv (OVV) to Acquire Nuvista Energy in C$18 per Share Deal

Ovintiv to acquire Nuvista Energy in $2.7 billion deal

Julian Klymochko, CEO of Accelerate Fintech, joins BNN Bloomberg to discuss the Ovintiv-Nuvista merger, expected to close on Q1 2026.

Ovintiv declares $0.30 dividend

Decoding Ovintiv Inc (OVV): A Strategic SWOT Insight

Decoding Ovintiv Inc (OVV): A Strategic SWOT Insight

Ovintiv (OVV) Acquires NuVista Energy for $2.7 Billion

Ovintiv (OVV) Acquires NuVista Energy for $2.7 Billion